In this article:

Credit Repair Scams: New Scam Types & How To Avoid Them

In credit repair scams, companies or individuals promise to improve your credit score using illegitimate means. Learn how to give these a wide berth.

What Are Credit Repair Scams?

Marie Morgan lost most of her life savings after she met an enigmatic stranger online [*]. He claimed to be in the military and said he needed money — ostensibly, to help his sick daughter.

Unfortunately, as Morgan would find out, it was all a deliberate scam. Just as she grappled with the aftermath of this financial loss, her phone rang again. The caller brashly offered to fix Morgan’s credit if she paid $400 per month for several years.

It was only after she inquired about a loan two years later when Morgan discovered that her credit hadn’t budged. She had been scammed once again — this time by a credit repair company.

In a credit repair scam, companies or individuals promise to improve your credit score through illegitimate means. This includes removing accurate or negative information from a credit file, or creating a new credit identity altogether. Scammers often charge steep upfront fees but fail to deliver on their promises — leaving victims worse off.

{{show-toc}}

How Do These Scams Work?

Each credit repair scam is different, but the common thread is a promise to improve your credit, often with little to no real-world results.

For instance, in 2022, the Federal Trade Commission (FTC) announced that it would shut down Financial Education Services [*]. The company had siphoned more than $213 million with its sprawling credit repair scheme.

A bulk of its illicit earnings came from a $99 upfront fee along with another monthly recurring fee of $89. Financial Education Services also had elements of a pyramid scheme.

It encouraged unknowing customers to parrot the same hyperbole — inflate credit scores and expunge accurate information from your credit file. Despite all its swelling promises, Financial Education Services was ineffective.

In another credit repair scam, a Maryland-based debt relief company marketed and sold an alleged “debt validation” program [*]. The program advertised a legally vetted process to eliminate credit card debt and resurrect poor credit scores.

The Consumer Financial Protection Bureau (CFPB), however, found that the company produced little evidence of such claims.

Whom Do These Scams Target?

Most victims have credit problems and want to improve or repair a wavering credit history. Scammers often prey on such individuals with poor credit and assert quick (false) fixes. And they almost always charge a fee in advance which is, of course, illegal.

Legitimate credit repair companies, on the other hand, tend to be nonprofit organizations. They seldom ask for upfront payments. In fact, they may extend free tools to help determine whether you need their services.

Types of Credit Repair Scams

Credit repair scams might play out in the real world in many ways. They often mislead customers with unrealistic promises about credit repair. Other conciliatory features may also include ineffective credit monitoring, identity theft protection, or credit protection services.

Below are a few examples of credit repair scams; there are several other scams that can cast aspersions on your credit. Proceed with caution if you see any of these warning signs.

1. Auto loan modification scams

A company might tell you that it can substantially lower your car payment. It may then charge several hundred dollars upfront to negotiate a deal with your lender. You may not realize this is a scam until your lender inquires about missed payments.

2. Credit card debt relief scams

In marketing their services, scammers can mislead consumers into believing that they qualify for a federal debt relief program [*]. Bogus companies may also falsely promise to reduce or cut your credit card debt over a span of 12–18 months.

⛳️ Related: How To Avoid the Credit National Assist Debt Relief Scam →

3. Credit piggybacking (tradeline renting)

Companies can make unsupported promises to artificially inflate your credit score. To do so, they will list you as an authorized user on the credit report of a consumer with good credit.

While this practice is not illegal, the FTC has taken legal action against some companies for promoting credit piggybacking [*].

4. Obtaining new credit identities

Fraudulent credit repair companies may also insist that you need a new credit identity. In lieu of your Social Security number (SSN), they claim that you can use an Employer Identification Number (EIN) or a Credit Privacy Number (CPN).

An EIN is a tax identification number used for a business, not an individual. A CPN is not a legitimate or recognized number by the government for credit reporting.

⛳️ Related: How To Repair Your Credit After Being The Victim of Identity Theft →

5. Student loan debt relief scams

Masquerading as a student loan servicer, some phony debt relief companies may charge advance fees. They mislead you into surrendering monthly payments intended to repay your student loans.

In the process, they may even lock you out of your Federal Student Aid (FSA) account using your FSA ID. This prevents real loan servicers from ever communicating with you [*].

6. Credit card interest rate reduction scams

Promises to permanently reduce credit card interest rates may entangle older Americans or those with mounting debt. One debt relief scam was shut down after it charged consumers between $995 and $4,995 for such services [*].

The victims found themselves deeper in debt and were also liable for fees to transfer any existing debt to new credit cards.

Is Credit Repair Legal?

Yes, repairing your credit and increasing your credit score is legal. Identity theft, financial hurdles, inaccurate information on your credit report, or poor spending habits could crater your scores.

However, sham companies defraud unknowing consumers by using the scams and deceptive practices mentioned above.

Credit repair, though often viewed skeptically, is also a legal right under federal laws. As such, two main credit repair laws allow individuals to dispute information in their credit reports.

Many states have additional regulations for this industry. These laws may require credit repair companies to have a state-licensed attorney on staff, for example [*].

- The Federal Trade Commission Act. One of the purposes of this law is to prevent deceptive business practices that can defraud consumers [*]. The FTC Act also empowers consumers to file complaints and receive redress when appropriate.

- The Fair Credit Reporting Act (FCRA). A stipulation under the Federal Credit Repair Organizations Act enables you to dispute credit history errors for free [*]. In other words, you don’t have to pay a credit repair company to do this for you.

- The Credit Repair Organizations Act (CROA). This act makes it illegal for credit repair companies to demand advance payments [*]. Some companies may create repayment plans to circumvent this law.

- The Telemarketing Sales Rule. This rule prohibits credit repair services that operate over the phone from charging a fee before they settle or reduce a consumer's debt [*].

⛳️ Related: How To Avoid the Financial Hardship Department Scam →

How To Recognize Credit Repair Scams

Generally, legitimate companies in this sector operate as nonprofits. They often offer free assessments and online tools to help gauge your situation.

They are usually willing to give you information about their services for free. Also, they will never charge you upfront for their services.

Most services that credit counseling agencies provide aren’t anything that you can’t do on your own. However, these agencies have the expertise, experience, and resources that can lead to better outcomes. Credit can be complicated, and counselors can help develop a personalized plan to repair your credit over time.

Legitimate credit counselors are not the same as credit repair companies. The latter often operates as a for-profit company that may deceive consumers or make outlandish claims.

If you’re appraising a company that displays any of these signs, consider it a scam:

- Guarantees a specific increase in credit score. Credit repair companies might pledge to raise your credit score by a certain amount, sometimes within a specific time frame. They might also claim that they can remove negative information from your credit report, even if it is accurate. No one can do this.

- Does not walk you through your legal rights. Among other provisions that scammers often withhold disclosing is your right to cancel the contract with the credit repair company within three business days of signing it [*]. They might also fail to tell you that you’re eligible for three free copies of your credit report every year via AnnualCreditReport.com.

- Instructs you not to contact any of the credit bureaus. If a company asks you not to contact one or all of the three credit reporting agencies — Experian, Equifax, and TransUnion — it may be a scam.

- Insists that you need a new identity. Obtaining a new credit identity is not an effective way to repair your credit; it may get you into legal trouble. These new identities often use stolen CPNs or SSNs.

- Coerces you to misrepresent information. Asking you to misrepresent information — including overstating your job title or income — is a red flag.

- Promises instant approvals. If a credit repair company promises instant approvals, such as for loans or credit products, it’s a scam. Credit repair isn’t for everyone, and legitimate credit counselors usually don’t approve every person who applies.

- Provides you a sham contract or none at all. Credit repair organizations cannot provide services without a written contract [*]. That contract must meet certain conditions — such as a full, detailed description of services as well as the terms and conditions of payment.

⛳️ Related: Three-Bureau Credit Monitoring: The 5 Best Options In 2023 →

To Report a Credit Repair Scam, Do This:

- If you believe that you have fallen victim to a credit repair scam, start by filing a complaint with the FTC by visiting ReportFraud.ftc.gov.

- You can also file a complaint with the Consumer Finance Protection Bureau (CFPB) by visiting consumerfinance.gov/complaint, or by making a toll-free call to 1-855-411-CFPB (1-855-411-2372).

- Another option is to contact your state attorney general, who is responsible for consumer protection laws. They might be able to take action against the fraudulent credit repair company. Visit the National Association of Attorneys General (NAAG) website for their contact information.

- The Better Business Bureau (BBB) is a nonprofit organization that helps resolve consumer complaints. By filing a complaint here, you can alert others of the scam and help them stay better informed.

Rebuilding Your Credit Takes Time

One of the reasons credit repair scams work is that people want a quick fix. They may plan to buy a car or a house soon and want shortcuts to repair bad credit in order to secure better financing.

But rebuilding your credit can take months or even years, depending on your credit standing. Here’s where a legitimate credit counseling agency could help.

- Look for accreditation. Certain nonprofit agencies offer accreditation for credit counselors. These include the National Foundation for Credit Counseling (NFCC) and the Financial Counseling Association of America (FCAA). These organizations set high bars for their member agencies, ensuring that they adhere to ethical and professional guidelines.

- Check government websites. Government entities such as the Department of Justice (DOJ) maintain lists of approved credit counseling agencies by state [*]. These agencies are compliant with applicable laws.

- Research the organization. Check for complaints about the agency with the BBB or other consumer protection agencies. Also ask for a free preliminary meeting and references from previous clients.

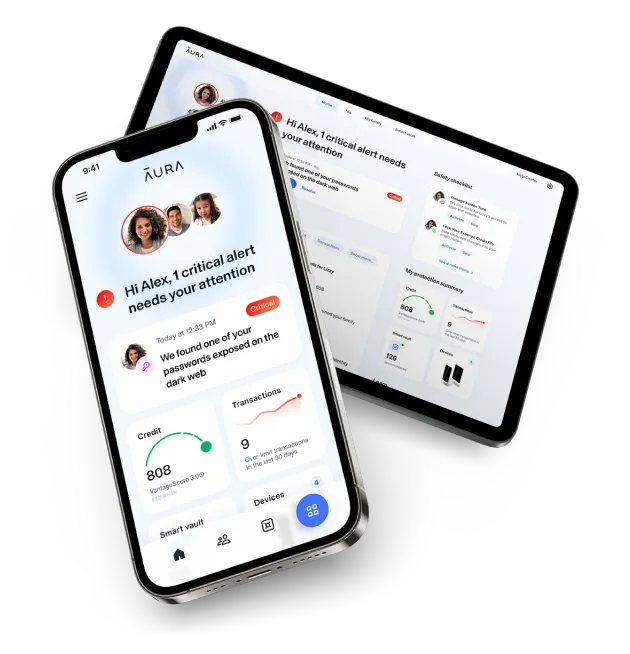

While these resources can help, sometimes you can be the victim of fraud despite your best efforts. Aura sends you alerts when any suspicious activity is detected in your bank, retirement, or other financial accounts.

You will also receive monthly and annual credit reports and near real-time alerts for any inquiries on your credit profile. Aura’s convenient credit lock feature can prevent fraudsters from opening new accounts in your name.

Shop, browse, and work online safely. Try Aura free for 14 days →

Editorial note: Our articles provide educational information for you to increase awareness about digital safety. Aura’s services may not provide the exact features we write about, nor may cover or protect against every type of crime, fraud, or threat discussed in our articles. Please review our Terms during enrollment or setup for more information. Remember that no one can prevent all identity theft or cybercrime.