In this article:

What is Credit Monitoring? Do You Really Need It?

Credit monitoring is one of the best ways to protect your credit score and catch the early warning signs of fraud — but only if you use the right service.

Credit monitoring is one of the best ways to protect your credit score and catch the early warning signs of fraud — but only if you use the right service.

What Are Credit Monitoring Services?

Credit monitoring services monitor your credit reports and alert you of changes — such as new accounts, hard inquiries, changes to your personal information, or drops in your credit score.

However, credit monitoring isn’t just beneficial for keeping tabs on your financial health and maintaining a good credit score — it’s also one of the best methods to catch the early warning signs of identity theft.

Unfortunately, not all credit monitoring services are equal. Free services typically only monitor one of the major credit bureaus (not all three) and are less reliable with alerts — while paid services are often bundled with identity theft protection and digital security tools.

If you want to protect your finances and your identity, you most likely could benefit from credit monitoring — as long as you choose the right service.

{{show-toc}}

How Does Credit Monitoring Work? What It Can And Cannot Do

Credit monitoring services track your credit reports at one, two, or all three of the major credit bureaus — Experian, Equifax, and TransUnion.

These tools work by making soft inquiries that pull your credit score and reports on a regular basis. Unlike hard inquiries — which are typically attached to an application for credit — soft inquiries won’t damage or affect your credit score in any way.

While most credit monitoring services offer similar features, not all of them monitor at the same level, or offer the same level of coverage — so make sure you understand how you’re protected before signing up.

For example, many tools only offer one-bureau protection, leaving your credit reports unmonitored with the other two bureaus — thereby making you susceptible to fraud. Look for credit monitoring tools that offer three-bureau credit monitoring to prevent fraud from going unnoticed.

{{show-cta}}

Free vs. Paid Credit Monitoring: Which One Is Better?

Free credit monitoring services focus almost entirely on tracking your credit score and report. Most of them only offer one-bureau credit monitoring and alert you to only major changes in your credit files — not all changes.

Many people who have their personal information leaked in a data breach are offered free credit monitoring. But not only are these services limited; they may also prevent you from taking legal action against the breached company if you sign up for its credit monitoring service.

Premium credit monitoring tools offer more robust protection and features at an affordable monthly price point.

Three-bureau monitoring and identity theft insurance are standard features included in most paid plans.

However, even paid services differ in how regularly they check your credit reports and how quickly they inform you of changes.

For example, a 2022 mystery shopper survey found that Aura provided the most consistent and fastest credit alerts when compared to other credit monitoring services3.

Here are some of the best credit monitoring services (both free and paid) to consider:

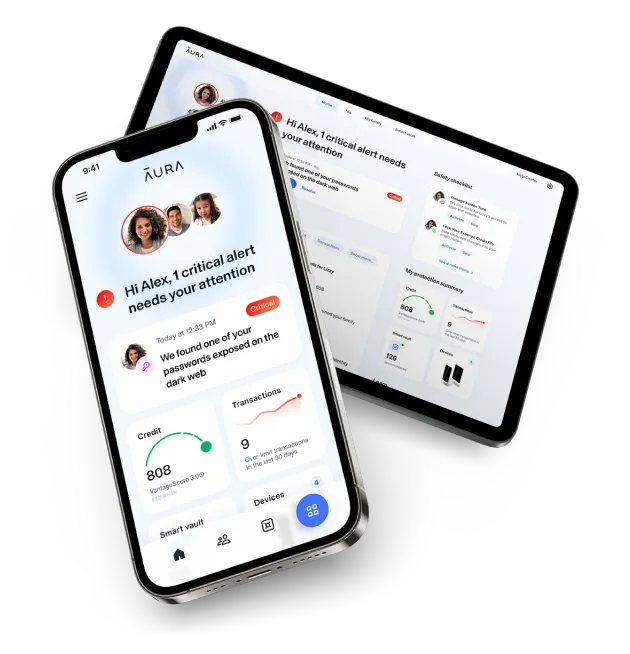

- Aura is an all-in-one digital security solution. You get three-bureau credit monitoring with the industry’s fastest fraud alerts on every plan, plus a full suite of identity theft protection and digital security tools. This includes antivirus, a virtual private network (VPN), password manager, Dark Web monitoring, optional AI-powered spam blocker, and more. Plans start at $9.99/month (using this special discount link).

- Identity Guard is an identity theft protection and credit monitoring service that constantly scans and monitors for new threats targeting your identity and personal information. Three-bureau credit monitoring is only available on the Total and Ultra Plans, starting at $17.50/month.

- Credit Karma offers free credit monitoring along with aggregated annual credit reports from two of the three credit bureaus. It can also quickly alert you to major changes, such as a new credit application filed in your name.

- Norton LifeLock was one of the first identity theft protection services to be offered. However, it only includes three-credit bureau monitoring and bank account and credit card activity alerts on its most expensive Ultimate Plus plan, starting at $19.99/month paid annually ($239.88/year).

- myFICO is the official FICO app. While the VantageScore® credit score model is more common nowadays, some lenders still reference FICO® scores. myFICO comes with credit score monitoring, Dark Web monitoring, and a credit score simulator. Three-bureau monitoring is only available on the Advanced and Premier plans, starting at $29.95/month.

The 6 Biggest Benefits of Paying for Credit Monitoring

There’s nothing wrong with using free credit monitoring services. However, paid credit monitoring tools generally come with more perks and additional features to help manage your cybersecurity.

1. Regular updates about changes to your credit score

While some fluctuation in your credit scores is normal, major unexpected drops or other changes could be indicative of identity theft.

For example, if a criminal takes out a loan in your name and makes late payments or doesn’t pay at all, this can severely damage your credit score — to the tune of 100 points or more [*].

Credit monitoring providers pull your updated credit scores on a regular basis so you can keep track of changes. Many paid tools pull your scores as frequently as daily. If you notice an unusual shift in your score, you’ll be able to take action quickly before major damage is done.

📚 Related: Credit Score vs. Credit Report — What's The Difference? →

2. Credit report monitoring at all three credit bureaus

There are three major credit bureaus — Experian, Equifax, and TransUnion. While some lenders run credit checks and report data to all of them, others don’t.

Free credit monitoring tools usually only monitor your credit with one or two of the bureaus — leaving you vulnerable to fraud that shows up on your other reports. You may not realize something’s wrong until you’re denied a new loan or credit card, at which point the fraud could take weeks or even months to resolve.

Most paid credit monitoring providers monitor your credit reports with all three credit bureaus. Triple-bureau protection ensures that you don’t have to worry about fraudulent activity or reporting errors that slip through the cracks unnoticed.

3. The ability to easily lock and unlock your credit file

A credit lock prevents unauthorized access to your credit reports and can reduce your chances of becoming a victim of identity fraud.

While you can manually freeze your credit reports with each individual bureau, many paid credit monitoring services allow you to conveniently lock and unlock your reports directly from their software.

This means you can easily keep your files locked when not in use — preventing fraudsters from ever being able to access them.

For example, Aura allows you to lock and unlock your Experian credit file by using biometric identity verification techniques such as Face ID or by simply toggling the on/off switch from the Aura mobile app.

📚 Related: Is Identity Theft Protection Really Worth It? →

4. Receiving transaction alerts that could signal financial fraud

If scammers have access to your personal information like bank account numbers and details, they could make fraudulent purchases or drain your accounts.

Credit monitoring services have evolved in recent years beyond just sending alerts about your credit score. Today, some paid credit monitoring providers can also alert you to suspicious activity and fraudulent transactions in your bank account — especially if these surpass a certain limit.

Aura uses machine learning to analyze your purchases and alert you of unfamiliar or unexpected charges. For instance, if you normally spend a few dollars at your local coffee shop and then are suddenly charged over $100, Aura will send you an alert.

If you don’t recognize the activity, you can quickly notify your bank to dispute the transactions and take steps to secure your finances.

📚 Related: Debt Collector Scams: How To Tell If a Debt Collector Is Legit →

5. Access to identity theft protection and digital security tools

Your credit is just one inroad for identity thieves to target you. That’s why most paid credit monitoring services are bundled with identity theft protection features to keep you safe.

This can include:

- Dark Web, data breach, and public record monitoring

- Home title and change-of-address alerts

- Data broker opt-outs to remove your personal information

- Password manager, antivirus, and a virtual private network (VPN)

- Phishing alerts, Safe Browsing tools, and optional AI-powered spam call blocker

6. Identity theft insurance

Free credit monitoring tools can help you keep tabs on your score and monitor for signs of fraud; but if the worst does happen, you’re on your own.

When you invest in a paid credit monitoring service, you’re typically covered by identity theft insurance. This is a type of insurance that helps offset legal fees and out-of-pocket expenses that are incurred as a result of ID theft.

The amount of coverage provided varies by company, but the industry standard is generally $1 million for eligible losses and expenses. Aura offers $1 million in coverage per adult — up to $5 million total on family plans.

How To Protect Yourself From Credit Fraud

You don’t necessarily need credit monitoring tools to shield yourself from potential fraud. On your own, you can:

- Rely on fraud alerts from your credit card companies and financial institutions (if they offer them). For example, many banking apps can send you notifications when a transaction is processed over a certain amount or an international transaction goes through.

- Review your online credit card statements monthly. Monitor your transactions to spot credit card fraud quickly. Work to keep your financial information safe online by only shopping with trusted merchants and protecting your accounts with strong and unique passwords.

- Manually freeze and unfreeze your credit when you need to use it. A credit freeze prevents fraudsters from accessing your file to take out loans even if they have your personal information.

- Request copies of your free credit reports. Every American is entitled to free weekly credit reports at AnnualCreditReport.com.

- Dispute fraudulent information and transactions in your credit file. You can do this by visiting the website for each bureau and following the dispute directions.

But the question you have to ask is: Do you want to do all of this work yourself? (And do you trust yourself to keep up with it?)

A paid credit monitoring service is a solid investment that takes much of the work out of protecting your credit score, finances, and even your identity. Aura works tirelessly in the background to safeguard your personal finances and credit — so you can enjoy peace of mind without having to navigate the task on your own.

Editorial note: Our articles provide educational information for you to increase awareness about digital safety. Aura’s services may not provide the exact features we write about, nor may cover or protect against every type of crime, fraud, or threat discussed in our articles. Please review our Terms during enrollment or setup for more information. Remember that no one can prevent all identity theft or cybercrime.