Is “Credit National Assist” Debt Relief a Scam?

“Credit National Assist” is just one of many fraudulent debt relief and credit counseling agencies used by scammers to ensnare vulnerable Americans who are worried about their finances — a population that’s only getting larger. According to a CNBC survey [*]:

70% of Americans say they’re stressed about their personal finances — giving scammers an easy way to target victims with credit repair scams.

While there are legitimate credit repair services available to help you with credit card debt or late payments, you need to know how to recognize the red flags of a scam.

In this guide, we’ll explain what the Credit National Assist scam is, warning signs to look out for, and what to do if you’re being targeted by one of these scams.

{{show-toc}}

What Is the “Credit National Assist” Scam Call?

The Credit National Assist scam is a phone scam in which fraudsters promise financial aid to victims through debt consolidation, lowered monthly payments, or even credit repair. In reality, these offers are fronts to gain access to your financial information, charge you upfront for bogus services, or steal your identity.

Scams like these are numbers games. Fraudsters make upwards of 74 million scam calls per day in hopes that a small percentage of people will fall for them [*].

Here’s how the scam typically plays out:

- You receive a call or voicemail from an unknown number — possibly showing up as “Credit National Assist” on your caller ID. Scammers call (often claiming to be a woman named “Rebecca”) and say they’re from a debt relief company. They promise to offer financial help or even invalidate your debts.

- Before you can get the debt relief offered, you’re asked to provide personal and financial details. Scammers commonly ask for your full name, address, and Social Security Number (SSN) — anything they can use to steal your identity. You may also be asked to provide account details for each of your lines of credit.

- Next, you’re asked to pay an upfront fee. Many scams involve an upfront fee for services which never materialize. It’s important to know that it’s illegal for debt relief companies to charge you any fees before offering you assistance [*].

- Finally, they tell you to stop communicating with anyone else. Fraudsters don’t want you to discover that they haven’t performed any debt relief services; so they tell you not to engage with your credit card company, creditors, or other debt collection agencies. Meanwhile, your accounts fall further into delinquency due to missed payments.

While there are some legitimate debt relief companies, scammers often impersonate them — as they know that victims in financial trouble are more likely to ignore red flags and go along with too-good-to-be-true deals.

📚 Related: Scammer Phone Numbers: Avoid These Area Codes →

How To Identify a Debt Relief Scam Call: 7 Warning Signs

Debt relief scammers are always adapting their strategies to try and get you to answer and engage with their calls. They may spoof local phone numbers, leave compelling voicemails, or even use stolen personal information to make the call seem more legitimate.

However, there are some telltale signs that indicate you’re dealing with a scammer on the phone. Here’s what to look out for:

- They claim to be calling you back from a supposed inquiry. To catch you off guard, debt relief phone scammers often claim to be calling you back. If you don’t remember calling a company or making an online request to be contacted, it could be a scam.

- They promise to invalidate all of your debts. No legitimate debt relief company will make guarantees about invalidating your debts – especially without knowing anything about your financial situation. Big promises like these are almost always red flags.

- Not having information about your debts or identity. If a caller doesn’t seem to know any details about your financial situation, they might not even know who you are. You’re likely just one of many potential victims that they’re calling.

- Asking for an upfront fee for their services. It’s illegal for debt relief companies to ask you for upfront payments. If you give money to one of these organizations, you’re actually just paying a scammer.

- Using generic-yet-legitimate-sounding company names. Fraudsters often use fake company names that are vague and don't tie them to a specific location or organization (like “Credit National Assist”). This allows them to cast a wider net for potential victims, without raising suspicion.

- Requesting that you stop communicating with your creditors. Be extremely cautious of any company that tells you not to engage with financial institutions or creditors. Scammers use this tactic to keep you in the dark when they pocket your payments.

- Continued calls – especially after you’ve asked them to stop. Companies are prohibited to continue contacting you if you’ve signed up for the National Do Not Call Registry [*]. Any debt relief company that doesn’t comply with the Do Not Call list is more than likely a scammer.

What about telemarketing companies? Some legitimate debt relief companies hire telemarketing firms to find customers for them. However, these companies cannot harass you, ask for upfront payments, or lie to you about their services. If they do, they’re breaking the law.

📚 Related: Does Credit Repair Work? What To Know Before You Sign Up →

What To Do If You Receive a Credit National Assist Scam Call

- Ignore or screen unknown callers

- If you answer, wait to speak

- Don’t give out personal information

- Report phone scammers to the FTC, FCC

- Protect your devices, identity

Credit National Assist scam calls are more than annoying. As scammers get better at hiding their identities or tricking you into answering their calls, this can put you and your family at serious risk of financial fraud and identity theft.

Here are five things you can do right now to shut down phone scammers and avoid the Credit National Assist scam:

1. Ignore or screen unknown callers with a spam protection app

The most effective thing you can do to protect yourself from financial assistance scams is to avoid answering unknown phone calls altogether. However, some scammers use spoofed caller IDs, so it can be difficult to tell if a call is actually coming from a legitimate organization.

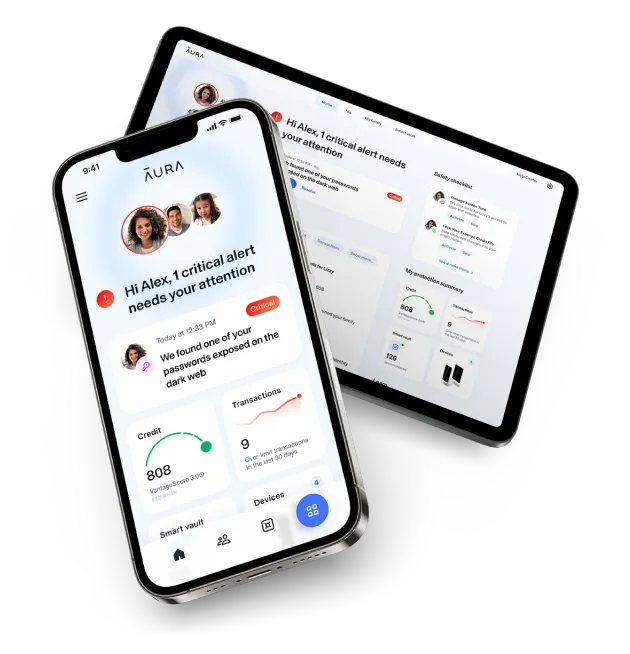

Using a spam protector like Aura’s AI-powered Call Assistant can help you filter out these kinds of calls.

How Aura protects you from phone scams and spam calls:

- Automatically blocks calls from known spam numbers. Aura checks incoming calls against the most up-to-date spam number lists to block known spam senders from reaching you. Callers will be blocked or automatically redirected to your voicemail.

- Answers and screens calls from unknown senders. Aura’s Call Assistant uses AI to answer unknown callers on your behalf and screen them for scams and spam. Only legitimate calls will be forwarded to you.

- Scans incoming text messages for spam language and phishing links. Aura filters out known spam numbers from your inbox and scans incoming messages for phishing. Any texts containing strange threats or potentially harmful links will be placed in your junk folder.

🏆

Shut down scammers with award-winning protection from Aura. Aura combines award-winning identity theft protection with AI-powered spam blocking tools, digital security, and more. Learn more about

how Aura protects you from scammers and fraudsters.

2. If you answer, wait to speak — and don’t respond with “yes”

If you end up answering an unknown or spoofed phone call, don’t speak first — especially if the person on the other end asks seemingly innocent questions like, “Can you hear me?” or asks you to confirm your name. This scam tactic has been making its rounds since 2017 and has one simple goal: to get you to say “yes” [*].

Fraudsters record your voice and use it to access sensitive accounts — such as your bank account. They could even create a voice print using AI to trick other people into thinking you’re calling them.

What to do instead: Respond with a question — such as “Who is this?” or “Why are you calling?” — rather than responding with an affirmative answer or statement.

📚 Related: How To Block Spam Calls (Android, iOS, and Landlines) →

If you receive a call offering you debt relief when you didn’t inquire about it first, don’t give out any personal information – even your name – until you confirm that the person is who they’re claiming to be.

How to verify an unknown caller’s identity:

- Ask questions. Real debt settlement companies will welcome any inquiries you have. If the person you’re talking to is pressuring you to act quickly while avoiding your questions, it’s probably a scammer.

- Find out who owns the phone number. Aura can reveal who’s calling. Otherwise, a simple Google search will do (you should avoid services that offer reverse phone number lookups as they may sell your data to marketers and scammers — such as USPhoneBook.com).

- Contact the company by using an official number. When in doubt, hang up and call back by using the company’s official contact number. If you can’t find any contact information, the company could be made up.

📚 Related: The 10 Best Spam Call Blockers of 2024 →

4. Report phone scammers to the FTC and FCC

Any potentially fraudulent phone calls you receive should be reported to the Federal Trade Commission (FTC) at ReportFraud.ftc.gov.

If you’re receiving repeated calls against your wishes or suspect a scammer is using a spoofed phone number, you should also report this to the Federal Communications Commission (FCC). You can file a consumer complaint by filling out this form or calling 1-888-225-5322.

📚 Related: What To Do If You’ve Been Scammed Out Of Money →

5. Protect your devices and identity with a digital security provider

While there are steps you can take to reduce the number of scam calls you receive, every now and then one may slip through the cracks. Investing in Aura’s digital security solution can provide you with an extra layer of protection.

Some of the features you get with Aura include:

- AI-powered spam call and text protection. Aura’s Call Assistant uses the latest technology to screen your incoming calls and texts for scammers, dangerous links, and spam.

- Award-winning identity theft protection. Aura monitors your most sensitive personal information across the Dark Web, public records, and more — and alerts you in near-real time if your data has been compromised or is being used by someone other than you.

- Online and device security tools. Calls aren’t the only route through which scammers can target you. Every Aura plan comes with tools that protect you against hackers and online fraudsters — including a military-grade virtual private network (VPN), secure password manager, antivirus software, and Safe Browsing tools.

- 24/7 support. If the worst should happen, Aura has you covered with 24/7 support from its team of U.S.-based White Glove Fraud Resolution Specialists.

🎯

Want to try Aura’s AI-powered spam blocker for yourself? Save up to 44% when you sign up for Aura today (with a 60-day money back guarantee).

Did You Give a Phone Scammer Money or Sensitive Data? Do This!

The good news is that simply answering a spam call won’t put you in serious danger (other than the fact that you’ll probably start receiving more spam calls, as scammers now know your number is active).

The real risk arises when you provide personal information that can compromise your identity.

Here are some steps you can take if you accidentally gave sensitive information to a scammer:

- Listen for the warning signs of a phone scam. Robocalls, long pauses before speaking, or a caller starting off with “Can you hear me?” are all telltale signs of a phone scam. If you answer and hear any of these, hang up and block the number from calling you again.

- Freeze your credit with all three bureaus. A credit freeze blocks access to your credit report — meaning anyone, including scammers, can’t open new accounts in your name. To protect your credit report with a freeze, you’ll need to contact each of the three bureaus individually: Experian, Equifax, and TransUnion.

- File an official identity theft report. If you gave up any personal information, you should file an official report with the FTC at IdentityTheft.gov. You may also need to file a police report with your local law enforcement.

- Report impersonation scams to impacted companies. If the scam caller you encountered was impersonating a legitimate company, it’s good to alert that company by using an official contact method. This will allow them to inform their customers and prevent further fraudulent activity.

- Contact your bank’s fraud department, and cancel any compromised accounts. If you sent money or provided your bank account details, be sure to contact the financial institutions in question to report the fraud. They’ll cancel any credit or debit cards that you have and issue new ones.

- Consider signing up for an identity theft and scam protection service. It’s nearly impossible to completely avoid phone scams in today’s world. Signing up for a digital security provider like Aura gives you and your family an extra layer of protection and helps safeguard your identity — hassle-free.

📚 Related: How To Repair Your Credit After Being The Victim of Identity Theft →

The Bottom Line: Don’t Get Burned Looking for Debt Relief

The so-called Credit National Assist Company and other fraudulent debt relief scams prey on people burdened by debt who are desperate for a way out. If you find yourself being targeted by these kinds of scam calls, consider an identity protection solution like Aura.

Hang up on phone scammers. Try Aura free for 14 days.

Editorial note: Our articles provide educational information for you to increase awareness about digital safety. Aura’s services may not provide the exact features we write about, nor may cover or protect against every type of crime, fraud, or threat discussed in our articles. Please review our Terms during enrollment or setup for more information. Remember that no one can prevent all identity theft or cybercrime.