In this article:

Why It’s Important To Check Your Credit Reports (and How To Do It)

Your credit reports can bring to light early warning signs of fraud or errors that could impact your credit score — but only if you know where to look.

Your credit reports can bring to light early warning signs of fraud or errors that could impact your credit score — but only if you know where to look.

How Often Should You Be Checking Your Credit Reports?

Your credit reports include important details about your credit accounts and actions, such as your payment history, account statuses, and credit inquiries. Your credit account information won’t only help you keep track of your financial health and credit score — it can also highlight mistakes, errors, and even fraud.

If you're not reviewing your reports from all three major credit bureaus — Experian, Equifax, and TransUnion — at least once per year, you might not detect signs of identity theft until it's too late.

The good news is that every American is entitled to free online copies of their credit reports each week from all three bureaus at AnnualCreditReport.com.

However, if you think you might be vulnerable to identity fraud or are planning a large purchase in the near future, you should consider signing up for a credit monitoring service that will monitor your reports for you and alert you as soon as any changes occur.

{{show-toc}}

5 Reasons Why It’s Important To Check Your Credit Reports

Almost everyone should be running personal credit checks once a year to look for mistakes — or even just to review their free credit scores.

However, you should be checking your reports much more frequently if you fall into one of the following groups:

- Previous victim of identity theft

- Recently lost your wallet or personal information/documents

- Experiencing dramatic credit score swings

- Applying for a large personal loan

- Part of a data breach

Checking your free credit report won't hurt your credit either, as it's considered a soft inquiry (and not a hard inquiry resulting from a credit application).

Here are some of the key reasons why you should start checking your credit reports right away.

1. Understand your credit position before making a big purchase

Before you make any major financial decisions — such as applying for a mortgage, auto loan, or even a credit card — you want to get an idea of what lenders are going to see when they look at your credit report.

A good credit score will ensure that your application gets approved, but it will also help you secure more favorable lending terms and interest rates.

Check your score early enough in advance so that you can make the necessary changes or repair your credit before applying. In particular, you want to look for things like negative information in your payment history or your debt-to-income ratio. At the very least, reviewing your credit report will arm you with information to help in any negotiations that might take place.

Example: You want to apply for a new car loan but aren't sure that you’ll be approved for the financing you need. When you pull your credit report, you see a few late payments on an old credit card that you had forgotten about — dragging down your credit score.

You decide to wait a few months and pay your bills on time to improve your credit history before applying so that you can get the best rate possible.

2. Spot signs of potential identity theft and financial fraud

Criminals can use stolen or leaked information to open new accounts or take out loans in your name. Unless you’ve enlisted the help of a credit monitoring service, you’ll be responsible for protecting your credit file against identity thieves.

Regularly checking your credit report may not prevent fraud, but it will make fighting and recovering from it much easier.

Fraudulent activity can take many forms on your credit report, but here are a few common red flags to look for:

- Unfamiliar credit accounts

- Unauthorized credit inquiries

- Incorrect personal information

- Inaccurate credit limits and balances

- Unexpected public records

Example: You notice a recent hard inquiry on your credit report, but you know that you haven't applied for any new credit in over a year. The lender who made the inquiry claims that a loan application was filed in your name.

You inform the lender of the fraud, quickly freeze your credit with all three bureaus, and report the identity fraud to the Federal Trade Commission (FTC). These steps can effectively shut down the scam before it has a chance to cause serious damage.

📚 Related: What Is Credit Monitoring (and Do You Need To Pay For It)? →

3. Identify inaccurate information that could harm your credit score

It's not only fraud that can hurt your credit score. Sometimes, unintentional mistakes are made by lenders, credit providers, or credit reporting agencies which can lower your credit rating. Possible inaccuracies may include:

- New accounts resulting from mixed files

- Open accounts that should be closed

- Mistakenly reported late or missed payments

- Incorrect credit balances, limits, and statuses

- Unremoved negative marks past the deadline

Depending on the situation, you can dispute errors formally with the credit reporting agencies or have them fixed by the information furnisher directly. While these types of mistakes don't typically have lasting effects, they can make a big difference in the short term.

Example: You plan to shop around for better auto insurance coverage, so you request a credit report to see where you stand. You spot a student loan account listed as open even though you paid off the remaining balance months ago.

Before you start contacting insurance companies for quotes, you call the student loan lender and have them update your file with the credit reporting agency, which leads to better rate offers.

4. Check that new accounts are being reported accurately

When a new credit account is first entered into the lender's system and reported to the credit reporting agency, it may include errors that can lower your credit score. Some potential errors include:

- Missing accounts (possibly added to the wrong credit file)

- Incorrect balances, limits, and payment terms

- Wrong status entered

- Improperly flagged as suspicious

If you catch these mistakes early, they can usually be fixed quickly and easily. In most cases, the lender will make the necessary changes without needing any further action from you.

Example: You successfully apply for a new credit card with a $5,000 limit, and use $500 of it. When you pull your credit report to ensure that everything looks as it should, you see that the credit card's limit has been misreported as $500. This puts your credit utilization at 100%, instead of the 10% that it should be. You fix this issue with the bank before it affects any future loan applications or interest rate decisions.

5. Improve your credit awareness and financial health

Regularly reviewing your credit report does more than just identify credit-damaging errors and fraud. This process can educate you about factors that impact your credit score and help you make more informed decisions that align with your financial goals.

When reviewing your credit reports, pay attention to trends in your credit utilization and payment history and how they affect your credit scores from month to month. Create actionable goals, such as paying off your highest-interest debt first and bringing your credit utilization to between 1%-10% — the ideal range for most lenders [*].

Example: You plan to buy a house at some point in the future and want to set yourself up for success. You start monitoring your credit to stay on top of your debts and keep your credit utilization within the optimal range.

When it comes time to apply for a mortgage, you're financially stable and your track record of timely payments and smart credit usage makes you an ideal borrower and a strong candidate for low rates.

What Information Is Included in Your Credit Reports?

Credit reports summarize your credit history in a fairly straightforward manner, but you should know what each section means in order to read and review it properly.

Here's a brief description of the credit information you'll find in your reports:

- Personal information. This section contains your personally identifiable information (PII), such as your name, address (current and former), date of birth, and Social Security number (SSN).

- Employment history. Your employer (current or previous) will appear as last reported by your creditors and lenders.

- Public records. Bankruptcies from up to 10 years ago can appear here, along with foreclosures in some cases.

- Consumer statements. Optional information you can add to reports that add context to your credit history or highlight unsuccessful disputes.

- Account details. Each of your outstanding credit accounts are listed and detailed, including the name of the lender, type of credit, payment history, balance, credit limit, and status (good/satisfactory or negative/adverse).

- Credit inquiries. Highlights all the requests to see your credit history, including hard inquiries (from employer and lender credit applications) and soft inquiries (credit updates and monitoring).

- Collections. Accounts that were sent to a debt collection company may appear as adverse accounts or in a separate collection account section.

📚 Related: How To Read a Credit Report (and Dispute Errors) →

Are your credit scores a part of your credit reports?

Credit scores are three-digit numbers that represent your creditworthiness. The higher your score, the better your chances of qualifying for new credit, loans, and lower interest rates.

Though credit scores are based on the information contained in your credit report, they don't actually appear in the report itself.

In fact, you can have many different credit scores depending on the model used (for example, VantageScores® vs. FICO® scores) and purpose of the credit application. For example, credit card lenders may place more emphasis on credit usage and payment behavior, whereas home and auto loan lenders focus more on stability and debt-to-income ratios.

Credit scores are calculated by using various credit report details, such as:

- Number and length of your credit accounts

- Credit utilization (how much of your available credit you're using)

- Payment history

- Types of credit accounts

- New credit and recent inquiries

Did You Find Errors in Your Credit Report? Do This Now!

Errors in your credit report can impact your credit score and financial health, but all damages are reversible if you act accordingly.

If you spot an error in your report, follow these steps:

- Freeze your credit file. Any errors in your credit report could be signs of fraud, and freezing your file will block anyone from accessing your credit. You will need to request a freeze with each of the major credit reporting agencies individually. Once in place, freezes remain active until you lift them.

- Report the fraud. If you notice clear signs of identity theft or fraud, start by reporting it to the Federal Trade Commission (FTC) at IdentityTheft.gov. They will provide you with a recovery plan and guidance for the next steps you’ll need to take. If the fraud is connected to a financial institution, report it there as well.

- Contact the information furnisher. Some credit issues can be resolved directly at the source. If you notice incorrect personal information, for example, you can clear that up by updating your contact details with your credit card companies. Lenders can also remove hard inquiries and late payment marks if you can provide proof of the mistake.

- Draft a dispute letter. For more serious issues, such as fraudulent credit accounts, erroneous public records, and incorrect account information, you may need to submit an official dispute letter. Dispute letters must include specific details about the error and proof of why the bureau should correct it.

- File the dispute. You should file your formal dispute with all three of the major credit reporting agencies. Each bureau has 30-45 days to respond to your dispute [*]. From there, you can appeal the dispute decision, submit a personal statement to your credit file, or file a complaint with the Consumer Financial Protection Bureau [*].

Are Credit Monitoring Services Worth It?

Keeping a close eye on your credit report has never been more important. According to the Identity Theft Resource Center [*], there were nearly 1,400 data breaches affecting over one billion victims in just the first half of 2024 alone.

While you can (and should) regularly order a copy of your credit report and look for changes and suspicious entries, committing to this time- and energy-consuming process isn't realistic for everyone.

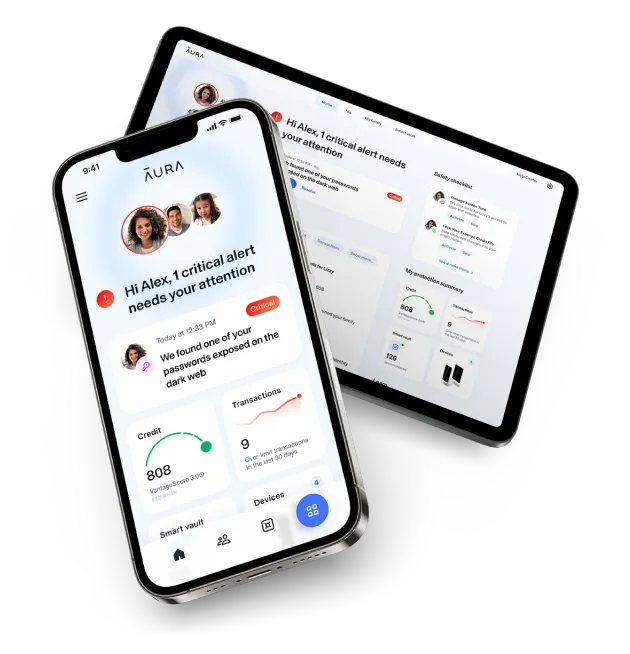

If you can't find the time, don't put it off. Assign the task to a reputable credit monitoring service like the one provided by Aura.

Every Aura plan includes:

- Three-bureau credit monitoring with the industry’s fastest fraud alerts3

- Identity, Dark Web, and data breach monitoring for your most sensitive personal information

- One-click Experian CreditLock to quickly lock your credit file

- Monthly credit scores

- Financial account and unusual transaction monitoring, powered by artificial intelligence (AI)

- Public records monitoring

- And more

Aura's all-in-one protection packages also include 24/7 access to U.S.-based certified customer support and fraud resolution specialists, plus up to $5 million in identity theft insurance.

Editorial note: Our articles provide educational information for you to increase awareness about digital safety. Aura’s services may not provide the exact features we write about, nor may cover or protect against every type of crime, fraud, or threat discussed in our articles. Please review our Terms during enrollment or setup for more information. Remember that no one can prevent all identity theft or cybercrime.