In this article:

The 6 Best Identity Guard Alternatives (Rated and Reviewed)

Identity Guard is one of the original (and best) identity theft protection services — but you still might be better off with one of these alternatives.

Identity Guard is one of the original (and best) identity theft protection services — but you still might be better off with one of these alternatives.

What Are the Top Alternatives To Identity Guard?

For over two decades, Identity Guard has been one of the top choices for protecting your identity, data, and finances — serving millions of customers and garnering consistently good reviews. But Identity Guard may not be right for everyone.

Some modern providers take a more proactive approach to identity protection than Identity Guard.

For example, Identity Guard is missing antivirus protection for your devices as well as other additional features that could help protect your data against hackers.

However, for customers seeking reliable identity and credit monitoring, helpful U.S.-based support, and generous identity theft insurance, Identity Guard is a fantastic option. But there are some cases in which you might be better off considering an alternative.

{{show-toc}}

Identity Guard Review: Plans, Pricing, and Standout Features

For the past 25 years, Identity Guard has helped to protect over 47 million customers against identity theft, financial fraud, hacking, and scams — including successfully resolving over 140,000 fraud cases [*].

Identity Guard is primarily an identity theft and credit protection tool, and offers three different packages of features, depending on your specific needs and budget.

All plans come with a basic digital security suite (Safe Browsing for protection against phishing links and a password manager) 24/7 access to a U.S.-based support team and up to $1 million in identity theft insurance. Beyond those features, the plan you choose will determine the level of protection you receive.

Here’s a quick breakdown of Identity Guard’s different plan offerings:

How much does Identity Guard cost?

Identity Guard’s plans range from $7.50 — $25/month for individual plans and $12.50 — $33.33/month for families (five adults and unlimited children) when you pay for an annual plan.

You’ll pay slightly more if you opt for monthly billing, and you won’t be eligible for the advertised 60-day money-back guarantee.

The bottom line: Identity Guard’s Value and Total plans are great options for individuals looking for affordable identity protection and insurance — but the more expensive Ultra plan may not include as many features, tools, or as much protection as some competitors.

📚 Related: Is Identity Guard Legit? What You Need To Know →

The 6 Best Identity Guard Alternatives in 2025

Identity Guard has made a name for itself as a budget-friendly, flexible, and intuitive identity protection platform. But that doesn’t mean it provides all the features you may need.

These are the best Identity Guard alternatives to consider based on cost, feature parity, and support:

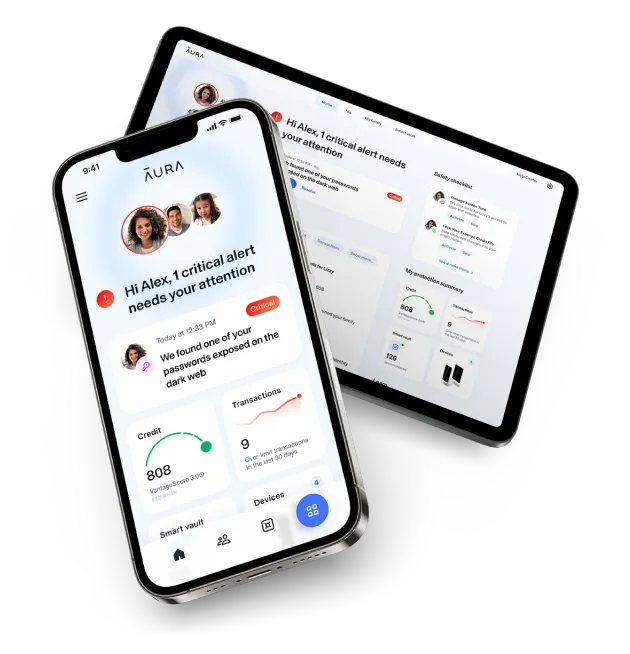

1. Aura

Why we picked it: Aura is an all-in-one intelligent safety solution that is consistently rated as one of the best identity theft protection services available. In the past year alone, Aura was rated the top provider by USNews.com, TechRadar, NerdWallet, Fobes, and others.

Some of the main benefits of signing up for Aura include its comprehensive identity and financial protection features, advanced digital security tools, and Aura’s highly acclaimed 24/7 U.S.-based support.

Every Aura plan also includes three-bureau credit monitoring with the industry’s fastest fraud alerts3.

Aura actively monitors over 140 pieces of personal and sensitive information — such as your Social Security number (SSN), credit card details, and passwords — across the Dark Web, data breaches, public records, and more.

All users also get access to full suite of digital security tools — including antivirus software, a military-grade virtual private network (VPN), phishing protection, a secure password manager, and more.

Aura currently holds a 4.4-star rating on third-party review site Trustpilot, with customer reviewers calling out its reliable support, ease of use, and fast alerts.

Best plan & average cost: Aura individual for $9.99/month (using this special discount code).

Aura’s individual plan offers some of the most extensive identity, device, and financial protection on the market, at one of the lowest prices available.

But where Aura truly shines is with full-family protection. For $24.99/month, you can protect up to five adults and an unlimited number of kids under the age of 18 — all with a single plan. Aura’s family plans also include child identity monitoring, parental controls, Safe Gaming and cyberbullying alerts, AI-powered spam call and text protection, and up to $5 million in identity theft insurance.

To ensure optimal family protection, Aura family plan members can reside in different households, such as kids away at college or elderly grandparents (who are often particularly vulnerable targets for cybercrimes and scams).

How it compares to Identity Guard: While Aura and Identity Guard are owned by the same parent company, Aura takes a more proactive approach to identity theft protection than Identity Guard. You’ll benefit from digital security for all of your devices and accounts, more extensive fraud protection, and optional parental controls and other online family safety tools.

2. IDShield

Why we picked it: IDShield markets itself as the only identity protection provider with “full-service identity restoration,” thanks to its parent company, LegalShield, which offers prepaid legal services.

When IDShield customers need help recovering their credit, they can tap into LegalShield’s network of private investigators for assistance. Members also get “unlimited” access to customer service and a 24-hour response SLA (service level agreement) for customer emails.

Other benefits of IDShield include optional three-bureau credit monitoring and up to $3 million in identity theft insurance coverage.

However, IDShield is more expensive than other Identity Guard alternatives like Aura — especially if you opt for a plan that includes three-bureau credit monitoring. Digital security tools aren’t built into the IDShield app and instead are provided by Trend Micro.

Best plan & average cost: Individual plan with three-bureau credit monitoring for $19.95/month.

While IDShield charges an extra $5/month for three-bureau credit monitoring, it’s still worth it for the peace of mind that you’ll get with near real-time alerts for suspicious activity across all three major credit bureaus (Experian, Equifax, and TransUnion).

Families should beware that IDShield costs upwards of $34.95/month for family protection, with no parental controls included.

How it compares to Identity Guard: IDShield has a leg up on Identity Guard when it comes to reputation management, spam control, and medical data protection. Yet its plans can only support up to three devices at a time, and they don’t include financial account monitoring. Plus, there’s no money-back guarantee.

📚 Related: IDShield vs. Aura Comparison: What You Need To Know →

3. IdentityForce

Why we picked it: IdentityForce is an identity theft monitoring service owned by TransUnion, one of the three major credit bureaus.

Due to its close tie to the bureau, IdentityForce’s premium plans provide fast, accurate credit-related alerts. However, its basic plans don’t come with credit monitoring at all. Instead, they lean heavily on Dark Web monitoring and security features like a VPN for mobile and online PC protection.

IdentityForce splits its offerings into two plan tiers — one that includes identity monitoring, and a significantly more expensive plan that bundles identity and credit monitoring together.

You can sign up for a free trial of IdentityForce’s UltraSecure plan — without credit monitoring — for 30 days. But the company doesn’t extend the same offer to UltraSecure+Credit plan holders.

Best plan & average cost: IdentityForce UltraSecure+Credit Monitoring for individuals for $34.90/month.

IdentityForce’s base plans do not include credit monitoring. For that reason, we recommend getting an UltraSecure+Credit plan and paying annually to get a discount. For individuals, these plans work out to approximately $29.16/month (when paid annually). For families, you’ll be paying closer to $33.23/month.

How it compares to Identity Guard: IdentityForce’s credit monitoring plans are more expensive than Identity Guard but do offer more device protection — if you’re a Windows PC user. IdentityForce’s privacy and data collection policies are also somewhat concerning for a company that provides identity protection services.

📚 Related: Is IdentityForce Legit? What To Know Before Buying →

4. PrivacyGuard

Why we picked it: PrivacyGuard is a credit reporting, credit monitoring, and identity theft protection service that’s been around for over 30 years.

PrivacyGuard offers a few unique features on its Total Protection plan — including an annual public records report, a registered offender locator, emergency travel assistance, and medical records reimbursement.

While PrivacyGuard offers a range of different plans for both credit and identity protection that’s similar to other Identity Guard alternatives, you’ll need to pay for the Total Protection plan. If you sign up via the Apple App store, you can get PrivacyGuard for $1 for the first 14 days.

Best plan & average cost: PrivacyGuard Total Protection for $24.99/month.

PrivacyGuard’s “all-in-one” plan costs more, but includes extensive credit score tracking, Dark Web scanning, and other tools like a credit score simulator, financial calculator suite, and credit information hotline.

How it compares to Identity Guard: Even though you get child SSN monitoring through the Total Protection plans, PrivacyGuard becomes more expensive than Identity Guard because PrivacyGuard does not offer family plans or annual discounts.

📚 Related: How To Protect Your Privacy Online →

5. ID Watchdog

Why we picked it: Like TransUnion, Equifax also has its own identity theft protection platform called ID Watchdog that provides extensive credit monitoring.

The entry-level Select plans come with monthly one-bureau (Equifax) credit reports, a VantageScore credit score, and Equifax Blocked Inquiry Alerts. ID Watchdog places special emphasis on child safety, including child credit monitoring in its base plan.

Unfortunately, unless you pay for the premium plan, you won’t get access to three-credit bureau monitoring, social monitoring, digital security tools (provided by Bitdefender), or child credit locks.

Best plan & average cost: ID Watchdog Premium for individuals at $21.95/month.

Despite being the most expensive plan, ID Watchdog Premium is closest in feature parity to Identity Guard and other alternatives. You get three-bureau credit monitoring, access to digital security tools, annual three-bureau credit reports, and more.

How it compares to Identity Guard: ID Watchdog has a wider range of credit monitoring features than Identity Guard. Plus, it comes with social account monitoring, Safe Browsing, and subprime loan monitoring for children — while Identity Guard family plans only include child online account monitoring and Social Security number monitoring.

6. LifeLock

Why we picked it: LifeLock is often regarded as one of the few household names in the identity theft protection industry.

LifeLock offers a wide range of products and plans, ranging from a new barebones Identity Advisor plan (providing just Dark Web and data breach alerts and access to customer support) to the fully featured (and expensive) Ultimate Plus plan that includes three-bureau credit monitoring, identity theft insurance, and more.

While this may sound simple, LifeLock’s plans and pricing quickly become complicated and expensive. Users can pay extra to add on Norton 360’s digital security tools and protect multiple adults or children.

All of LifeLock’s advertised pricing only applies to your first year as a customer — after that you’ll pay 30–50+% more for the same plan.

In addition, potential buyers should beware of the fact that LifeLock has suffered multiple security incidents and data privacy debacles in recent years. This includes a credential stuffing attack that compromised the passwords of nearly one million users.

Best plan & average cost: LifeLock Ultimate Plus with Norton 360 for individuals at $25/month for your first year (plan renews at ~$30.41/month).

If you want the same level of all-in-one protection as Aura and other Identity Guard alternatives, you’ll need to opt for LifeLock’s top-tier plan. While this is a pricey option, it gives you access to three-bureau credit monitoring as well as up to $3 million in insurance coverage, including $1 million in stolen funds coverage.

How it compares to Identity Guard: A combined Norton 360 with LifeLock plan can provide users with more digital security than Identity Guard. Yet some LifeLock customers complain about slow and unhelpful service [*]. This feedback, its previous breaches, and steep price increases may leave you wondering whether a LifeLock plan is worth it.

📚 Related: Identity Guard vs. LifeLock: What To Know Before You Choose →

Are Aura and Identity Guard the Same?

No. While Aura and Identity Guard are owned by the same company, they aren't the same product. Each service has its own unique approach to identity theft protection (and set of features) that may appeal to different customers.

The main differences between Aura and Identity Guard are that:

- Identity Guard offers more flexible, budget-friendly plans. These plans are easier on the wallet, but lack the cybersecurity features, three-bureau credit monitoring, and White Glove Fraud Resolution that Aura provides.

- Aura offers digital security tools like ad and site tracking blockers and a military-grade VPN to protect you on public Wi-Fi. Plans also come with an optional spam call and text detection feature that is powered by artificial intelligence (AI).

- Aura is more family oriented — offering parental controls, Safe Gaming with cyberbullying alerts, and child-specific identity protection features like SSN alerts, three-bureau credit freeze, and sex offender geo-alerts.

The bottom line: Both services are top-tier options and regularly appear on lists of best identity theft protection providers. Your choice depends on the features you value most and your ideal price point.

📚 Related: 8 Reasons Why It's Important To Have Identity Theft Protection →

Final Thoughts: Identity Theft Protection Is a Full-Time Job

Identity theft protection can be a valuable tool for nearly everyone — especially in light of the extreme rise in data breaches and leaks since the start of 2024 [*].

But whether you choose to sign up for Identity Guard, Aura, or an alternative, it’s important to remember that no service can prevent all types of identity fraud.

Along with a tool that monitors and alerts you to data leaks, protects your data and devices, and provides support and insurance coverage, here are some protective measures you can take:

- Freeze your credit with all three bureaus. Credit freezes lock down your credit files, preventing identity thieves from opening loans or new accounts in your name. Contact each of the three major credit bureaus (Experian, Equifax, or TransUnion) to place a freeze which will last until you lift it.

- Set up fraud alerts with your bank and financial institutions. Most banks have security algorithms that scan customer accounts for signs of identity theft. Enrolling in text, email, or phone alerts can help you spot potential identity theft.

- Share less information online (and update your social media privacy settings). Cybercriminals use the information and pictures you post to fuel phishing scams or pose as you online. Make your social media accounts private. Restrict access from third-party apps, and refrain from tagging your location. Never reveal any sensitive data.

- Use digital security tools on your devices. If you don’t want to opt for an all-in-one provider, consider dedicated digital security software or a mobile app that includes protection against malware, clicking on phishing links, and Wi-Fi snooping.

- Make sure your online accounts have 2FA enabled. Strong passwords should be your baseline, but even those can be leaked in data breaches and leaks. With two-factor authentication enabled, hackers must provide a second authentication method like a FaceID or authenticator app code to access your accounts.

- Notify the Federal Trade Commission of fraud. If you think you’re a victim of identity theft, submit a report through IdentityTheft.gov. While the FTC won’t investigate your case, it will share details of the case in a broader database used by law enforcement. And the FTC will provide you with a personalized identity recovery plan.

Let Aura keep you and your family safe online — Try Aura free for 14 days

Editorial note: Our articles provide educational information for you to increase awareness about digital safety. Aura’s services may not provide the exact features we write about, nor may cover or protect against every type of crime, fraud, or threat discussed in our articles. Please review our Terms during enrollment or setup for more information. Remember that no one can prevent all identity theft or cybercrime.