Is Ally Bank Safe To Use?

With multiple deposit accounts and attractive interest rates, Ally Bank is a popular alternative to traditional banks like Chase, Bank of America, and Citibank. But in recent years, fraud and scams have become serious problems for Ally Bank and its customers.

A data breach in 2021 led to a class action suit. But while the bank has dismissed those claims, scammers continue to use brute force attacks against Ally debit cards — draining the bank accounts of thousands of customers [*].

Callie Jagoe lost over $6,000 to an Ally Bank scam — and didn’t get her money back until she made a complaint with the North Carolina Attorney General’s office [*].

If you’re an Ally Bank customer, you need to know about the latest scams and vulnerabilities that could put your account — and money — at risk. In this guide, we’ll cover the most common Ally Bank scams by showing you what to watch out for and how to avoid becoming the latest victim.

{{show-toc}}

What Are Ally Bank Scams? How Do They Work?

Ally Bank scams are a type of bank scam in which fraudsters impersonate Ally Bank staff members. These con artists contact Ally Bank customers and attempt to obtain sensitive information — like account details and card numbers — or trick victims into making transfers.

Most people do their banking online now, which makes bank imposter scams an effective way for criminals to access your sensitive data. A single phishing email or spam call could enable someone to access your savings account in minutes.

Scammers have a vast array of attacks they can use to deceive you. Here are a few possible ways Ally Bank scams play out:

- Fake Ally text messages. Fraudsters send phony security notices claiming to be from Ally Bank with the goal of getting victims to click on malicious links.

- Phishing emails. Criminals send out fake emails that appear to be from Ally Bank. Like bogus texts, phishing emails include fraudulent links or attachments that can either trigger a malware download on your device or lead you to an unsecured website that steals any information that you enter — including your financial account details.

- Phone calls impersonating Ally employees. Fraudsters adapt the phishing concept for voice calls. This impersonation ploy is known as vishing, and allows fraudsters to put more pressure on victims to give up personally identifiable information (PII).

- Password hacking and data breaches. Cybercriminals can buy leaked password lists on the Dark Web after a data breach. If your password is compromised, someone can hack your account and lock you out.

- Fake Ally websites. Fraudsters can trick you into sharing sensitive information by creating fake websites that look like the real Ally Bank site.

Being the victim of a bank impersonation scam can cost you your life savings or even your identity.

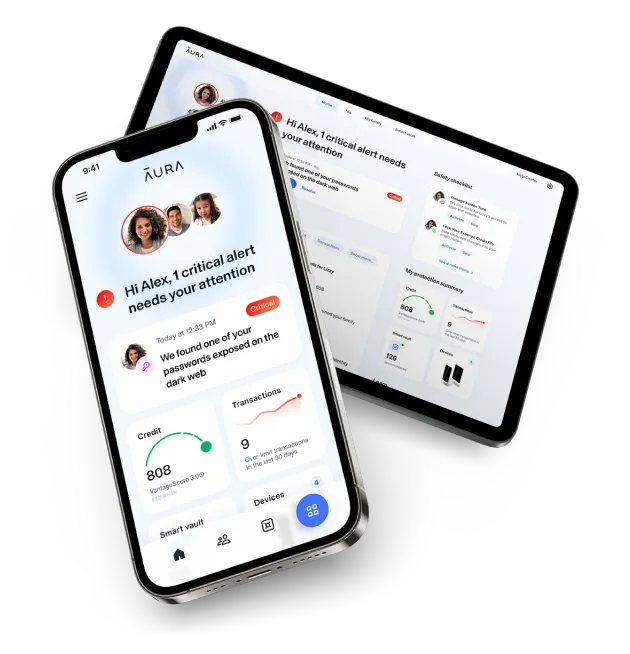

That’s why it pays to protect yourself with an all-in-one digital security provider that monitors your accounts, warns you of scam texts and calls, and provides 24/7 support and insurance in case you get scammed. Try Aura for free today →

The 7 Latest Ally Bank Scams You Need To Know About

- Fake fraud alert phishing emails

- Text messages about fake Zelle or Venmo transfers

- Emails and texts claiming there’s an issue with your account

- ATM skimmers and shimmers

- Data breaches that leak your Ally Bank password

- Phone calls from fake Ally Bank representatives

- Unexplained debit card charges

Scammers can target you in many ways — so it's essential to be prepared. Here are seven Ally Bank scams you need to know about in 2024:

1. Fake fraud alert phishing emails

In this scam, you receive an email claiming to be from Ally that states there were suspicious transactions on your account and that you should call a number to confirm or refute the transactions.

But when you call, you end up on the line with a fake bank employee who asks for sensitive information that gives them access to your bank account — such as your name, address, phone number, security questions, and last four digits of your Social Security number (SSN).

How to identify and avoid a “fake alert” phishing email scam:

- Double-check the sender’s email and “from” name. Scammers use spoofed email addresses and “from” names to trick you into believing they’re legitimate. Always click on the “from” name to reveal the sender’s true email address. If it isn’t from an official Ally.com email address, it’s a scam.

- Hover over links in emails before clicking. If you see a suspicious link in an email, hover your cursor over it without clicking to see the actual URL.

- Check the URL before entering your login information. If you are asked to log in to your Ally Bank account, verify the URL before entering your credentials. If in doubt, log in to your Ally account directly by typing the URL in a new browser window.

🏆

Get award-winning protection against bank scams and fraud. Aura’s all-in-one solution monitors your data and alerts you to potential fraud across all of your financial accounts — and can even block scam texts and calls before they reach you. Try Aura

free for 14 days.

2. Text messages about fake Zelle or Venmo transfers

Scammers send text messages that claim you have a pending money transfer from Zelle, Venmo, or Cash App — all you need to do is share your details or pay a small fee to receive it.

In other situations, scammers pretend to be Ally employees claiming that your account has been compromised, and you need to transfer your savings to a “safe” account by using a payment app. But, because peer-to-peer transfer apps are connected directly to bank accounts or debit cards, transfers are almost immediate and nearly impossible to cancel.

How to identify and avoid a Zelle or Venmo scam:

- Link your credit card to your account — not your bank account. If something happens, it’s much easier to cancel a credit card and recoup damages. Venmo lets you make payments with a credit card at a 3% fee.

- Beware of requests for self-transfers. Scammers often convince their targets to “send money to themself” to protect it from fraudsters. But this double-bluff is all part of the scam. If anyone asks you to do this, hang up and block the number.

- Be skeptical about unsolicited requests. Never send money to anyone you don’t trust, and remember that if someone is pressuring you to make a payment, it’s highly unlikely this person really works for a bank.

💡 Related: Did You Get Scammed on Cash App? Here’s What To Do →

3. Emails and texts claiming there’s an issue with your account

Many Ally Bank scams begin with a simple email or text message claiming there have been fraudulent charges or other issues with your account that require your immediate attention.

Example of an Ally Bank phishing email trying to get the recipient to download an attachment. Source: Reddit

Example of an Ally Bank phishing email trying to get the recipient to download an attachment. Source: RedditLike other types of phishing scams, the goal is to entice you to click on a link or call a number to resolve the issue. If you engage, you could end up on a fake website or a phone call with a criminal impersonating a bank employee.

How to identify and avoid email and text scams like these:

- Verify the sender's identity. Check the sender's email address or phone number to ensure it's from a legitimate source. If in doubt, contact Ally Bank directly by using the customer support number on the official website.

- Study the email for mistakes. You can often spot fraudulent communications because of grammar issues, typos, or strange formatting in the text or design. Professional banks and financial institutions don't make such glaring errors.

- Don't click on links or download attachments. Even if an unsolicited message looks convincing, you should avoid clicking on links or attachments — they could lead to phishing websites or initiate a malware download.

4. ATM skimmers and shimmers

A credit card skimmer is a small device that someone illegally attaches to card readers to steal credit or debit card data. These “skimmers” are designed to hide in plain sight at a point-of-sale (POS) or on an automated teller machine (ATM).

Fraudsters use ATM skimming to illegally obtain your personal information, such as your card or routing number, CVV codes, expiration dates, and PINs. When scammers have your bank information, they can access your checking account, steal your money, and even impersonate you through identity theft.

How to identify and avoid an ATM Skimmer scam:

- Wiggle the card reader slot, and try to shift the keypad. ATM skimmers are not firmly fixed in place, so they will move around if you grab hold of them.

- Look for hidden cameras above the keypad. Skimmers are sometimes paired with a small camera to record your PIN, or even a keypad overlay to record your keystrokes.

- Go with cardless ATM transactions. Using your smartphone and bank's mobile app, you can conduct ATM transactions anywhere without a physical debit card.

💡 Related: What Can Scammers Do With Your Bank Account Number? →

5. Data breaches that leak your Ally Bank password

A data breach is a security incident in which unauthorized parties access, steal, and spread sensitive, confidential, or protected information. Hackers could crack the computer network of your local Ally Bank and then share stolen customer information online — including bank account numbers, customer addresses, and phone numbers.

In 2021, a programming code error on Ally's website exposed customers' usernames and passwords to Ally's business partners. While the resulting class action lawsuit was dismissed, the public outcry did untold damage to the bank’s reputation [*].

How to identify and avoid data breaches:

- Turn on alerts. In the settings of your Ally Bank app, make sure you enable notifications about any data breaches. You can also follow Google alerts for news about data breaches or incidents at your bank.

- Change your passwords. If you believe your account may have been compromised, immediately update your password. Opt for long, strong combinations of random characters, numbers, and letters that are impossible to guess.

- Use two-factor authentication (2FA). You should always protect your most valuable online accounts with multi-factor authentication — ideally through biometrics or an authenticator app.

Scammers use spoofed phone numbers and voice-altering software to pose as reputable companies (or individuals). You might see your bank appear on the caller ID, but it could be a con artist spoofing your bank number.

For this reason, it’s crucial to tread carefully whenever you get a call from someone claiming to represent Ally Bank or its parent company, Ally Financial Inc. If you implicitly trust anyone who calls, you could walk into a trap that costs you your savings and even your identity.

How to identify and avoid vishing and phishing scams:

- Hang up if they ask for personal information. When legitimate Ally representatives call you, they only ask to verify your name and secret question. If the caller wants your PIN or online account details, consider this a clear sign of a scam!

- Deny requests for a one-time passcode. Ally Bank reps will never ask you to text or tell them a one-time passcode to verify your account.

- Ask them questions. Asking a question such as, "When's the last time I called you?" often places fraudsters on the back foot, leading them to hang up.

💡 Related: How To Identify a Scammer On The Phone →

7. Unexplained debit card charges

Since 2022, a raft of Ally Bank customers have reported fraudulent charges and other forms of debit card fraud. Curiously, many of the victims claim they have rarely used the cards — or have never even activated them [*].

As all Ally Bank cards start with the same four digits — the Bank Identification Number (BIN) — hackers can use automated software to guess the card numbers and effectively launch BIN attacks against hundreds or even thousands of customers at once.

How to identify and avoid debit card fraud:

- Keep a low balance. Make sure the bulk of your savings is protected in a separate, secure account. You can transfer money to your debit card once a month without any penalties.

- Disable overdraft features. While an overdraft may help when you have insufficient funds when paying at your local store’s checkout, it could also allow thieves to steal more money from your account — and leave you with higher debt.

- Set up bank alerts. Enable emails, text messages, or mobile notifications to get real-time updates if there are any suspicious charges or activity on your account. A quick response will help you limit the damage.

⚡️

Get warned fast if fraudsters are using your bank or credit. Aura’s award-winning digital security solution monitors your debit and credit cards, investment accounts, credit file, and more to alert you of fraud.

Try Aura for free today.

Were You the Victim of an Ally Bank Scam? Do This!

As soon as you recognize the warning signs of identity theft or fraud, you must act quickly to limit the damage to your finances and credit score. The steps you take depend on whether you have already paid the scammer, what payment method you used, and the personal information at risk.

Here’s what to do:

- Report account fraud to the bank immediately. If you think your Ally Bank account is compromised, call the Ally fraud hotline at 1-833-226-1520. Tell them to freeze your account and cancel the cards. If it’s not too late, they may be able to recall transfers.

- Freeze your credit reports. Contact each of the three major credit bureaus individually (Equifax, Experian, and TransUnion) and ask them to freeze your credit file. This way, no one can access your file, take out loans, or open accounts in your name.

- Order a credit report. You can get a free three-bureau credit report at AnnualCreditReport.com. Review your credit reports carefully to check for any inconsistencies or unfamiliar activity. In addition to fraudulent purchases, look for any attempted changes to your profile’s mailing address or phone number.

- Change your passwords immediately. Once you detect a breach, create new passwords; aim for strong, unique passwords for every account, and securely store them in a password manager.

- File an official report with the Federal Trade Commission (FTC). You can file an identity theft report online at IdentityTheft.gov and get an official affidavit confirming that you are a fraud victim. This is essential for disputing fraudulent charges, debts, and accounts.

- Close all fraudulent accounts. If you discover an account opened in your name without your knowledge, contact the company directly and ask them to close it. Provide your FTC report as proof of the fraud, if required.

- Dispute unauthorized charges. If you have lost money due to a scam, contact Ally Bank to report the loss and request an immediate refund.

Unfortunately, there’s no guarantee you’ll recover lost money if you get scammed. For this reason alone, it’s better to proactively protect your accounts from Ally Bank scams.

💡 Related: Do Banks Refund Scammed Money? (How To Dispute Fraud) →

How To Protect Your Ally Bank Account From Fraud and Scams

- Never share your bank account details. No one needs to know this information — even your bank. If someone asks for a 2FA code, PIN, or password, they’re trying to scam you.

- Use strong, unique passwords. Use a combination of uppercase and lowercase letters, numbers, and special characters to secure your password for every account.

- Enable two-factor authentication. Many financial institutions like Ally Bank have two-step or two-factor authentication built into their security procedures. This second verification factor makes it harder for hackers to gain access.

- Log in to your account via official channels. Only access your Ally Bank account through the official website (https://www.ally.com) or the Ally Mobile Banking app.

- Use a spam call and text blocker. Aura provides a spam call and text blocking feature that filters out suspicious contacts, reducing the risk that you’ll engage in conversations with fraudsters.

- Regularly review your bank account statements. To ensure the security of your Ally Bank account, it's important to stay vigilant and review your account statements for unauthorized transactions.

- Don’t get pressured into acting quickly. Watch out for suspicious emails, texts, or calls in which someone urges you to make a quick money transfer. Any urgency or pressure tactics are telltale signs that you’re dealing with a scammer.

- Only connect to your online bank via secure networks. It’s easy for hackers to compromise unsecured public Wi-Fi, so always use a virtual private network (VPN).

- Sign up for a credit and financial transaction monitoring service. To help detect potential fraud and identity theft early, consider investing in an all-in-one provider like Aura that protects you from Ally Bank scams and a wide variety of other common cyber threats.

💪

Protect your finances, identity, and data — with Aura. Try Aura

free for 14 days!

The Bottom Line: Aura Can Help Protect You From Ally Bank Scams

Criminals target Ally Bank customers with scams that can quickly drain your savings. If they target your debit card, the theft could cost you thousands. Worse still, these cards have little protection compared to credit cards, so you might never get your money back.

Now that you know how to spot the warning signs of Ally Bank scams, you can take a proactive stance against scammers. But for the best protection and peace of mind, consider Aura’s all-in-one solution to shield your identity, family, and finances from fraudsters.

Here’s how Aura keeps you safe:

- #1-rated identity theft protection. Aura constantly monitors for any suspicious activity connected to your bank account numbers, SSN, and personal details — like your phone number, address, and home title.

- 24/7 three-bureau credit monitoring. Keep tabs on your credit reports with rapid fraud alerts that are up to 250 times faster than other digital security providers3.

- Safe Browsing and phishing protection tools. Stay safe online with antivirus software, a VPN, a secure password manager, and email aliases.

- AI-powered Call Assistant. Avoid costly phone scams and phishing messages with smart spam-blocking and call-screening features.

- White Glove Fraud Resolution Specialists. A dedicated team of U.S.-based 24/7 experts helps you navigate challenges with banks, creditors, and government agencies.

- Up to $5 million in insurance coverage. Every adult on your Aura plan is covered for eligible losses due to identity theft, such as stolen money, legal fees, and passports.