In this article:

Do Banks Refund Scammed Money? (How To Dispute Fraud)

While banks are generally obligated to refund money lost to fraud, they may deny the refund if you were negligent or involved in the scam.

Whether or not your bank will refund scammed money depends on the bank's policies, the type of scam, and how you paid. But there are consumer protections available.

Do Banks Refund Scammed Money?

Banks often refund scammed money, but it's not guaranteed. The likelihood of a refund depends on your bank's policies, the type of scam, the payment method used, and how quickly you report the fraud. To increase your chances of recovering your money, take these steps.

{{show-toc}}

1. If you notice an unauthorized payment

In most cases, unauthorized payments are protected by the Electronic Fund Transfer Act (EFTA). If you report them within two days, you won’t incur any liability [*].

If you lose your debit card, suspect it’s stolen, or receive alerts about suspicious activity:

- Contact your bank. Explain your situation, and request a card replacement. You may be asked to submit a written statement to support your claim.

- Wait for the investigation results. Investigators will review your account history, the fraudulent transaction value, and where the transaction occurred in order to confirm whether there was foul play. Any errors they find must be corrected within one business day [*].

If you see an automatic payment on your checking statement that you didn’t make:

- Write to the vendor. Ask them to stop charging your account, and include proof of the charges and of your cancellation.

- Place a stop payment. Call your bank and put a stop payment order on the recurring transaction at least three business days before the next scheduled payment [*]. Stop payment orders are only good for six months. It may also be worth talking with a bank representative over the phone or in person to make sure automatic payments don’t happen again.

If you see an unauthorized check withdrawal:

Generally, you have 60 days from your last bank statement to file a report. But it’s best to submit your fraud claim in writing as soon as you notice it in order to minimize your liability [*].

📚 Related: How To Protect Your Bank Account From Identity Theft →

2. If there are unknown charges on your credit card

The Fair Credit Billing Act (FCBA) limits consumer liability for credit card fraud to $50 in most cases, regardless of when you report [*]. But the sooner you flag fraudulent credit card transactions, the faster you get your money back.

- Call the customer service number on the back of your card. Explain that you’re a victim of fraud and share details about the unauthorized charges.

- Follow the credit card provider’s dispute process. Submit statement transactions, receipts, and proof that you were in another location when the bogus charges were made.

The bank will either reverse the charges within three business days or send a written explanation detailing why they denied your claim [*].

📚 Related: Bank Account Hacked? Here's How To Get Your Money Back →

3. If you think someone has access to your account

Unfamiliar charges or strange notifications on your bank account are red flags. Review your recent transactions for signs of fraud, and report missing money within two days.

If someone stole your security code or PIN, you won’t be responsible for transactions over $50.

- Change your account passwords. To stop hackers, create complex, unique login credentials for your online banking accounts. Never store financial information, such as your account number or ATM PIN, in your wallet or phone. If either is stolen, fraudsters get instant access to your accounts.

- Use multi-factor authentication (MFA). Biometrics, authenticator apps, and hardware security keys make it almost impossible for criminals to access your account information.

4. If you paid a scammer

Many scammers use pressure tactics to force victims into sending money through payment methods that are notoriously tough to reverse.

Using a wire transfer:

You may be able to stop the wire before it gets to the recipient. For example, Wells Fargo wires that are listed in the Scheduled status can still be canceled from the Wire details page [*].

- If you used a remittance transfer provider, you have 30 minutes to request a reversal. Instructions for how to do so will be on your wire transfer receipt. Note that reversals won’t work if funds have already been deposited into the beneficiary’s account.

- If you made an international wire transfer, check the timeframe for cancellation on your money transfer receipt. Some banks, like Chase, will only display a cancel option if that action is still available [*].

- If you made an ACH payment, you have 24 hours to request a reversal. You may be able to submit a reversal request online or over the phone, but some banks require a written form.

Using a payment app:

Peer-to-peer payment apps like Venmo, Zelle, PayPal, and Cash App have their own rules for stopping bank transfers.

- If you paid on Venmo, submit a ticket to reverse the payment.

- If you paid on Zelle, call their support team at 844-428-8542 to see if you are eligible for reimbursement because of an imposter scam [*].

- If you paid on PayPal, you need to ask the recipient to refund you. If you don’t hear back from them and your payment was sent as Goods and Services, open a dispute in PayPal’s Resolution Center. You might be covered by PayPal’s $0 Liability program [*]. Payments sent as Family and Friends cannot usually be canceled.

- If you paid on Cash App, file a dispute. In your app, select the unauthorized transactions, then Need Help & Cash App Support. Tap on Dispute this Transaction and fill out the form. Alternatively, call customer support at 800-969-1940.

Using gift cards

If a scammer duped you into buying gift cards:

- Keep your receipt. Most gift card companies will ask for it when you report fraud.

- Contact the gift card company. Use the FTC’s official contact information for common gift card vendors like Amex, Apple, Google Play, Target, Walmart, Visa, and Amazon, and ask for your money back. If the scammer hasn’t yet spent the funds, you may be able to recover them.

- Report fraud to the Federal Trade Commission. Your case can help the FTC find and shut down gift card schemes. Go to ReportFraud.ftc.gov and share as much information as you can about the scam.

For all these payment methods, including gift cards, you can try requesting a chargeback under Regulation E [*].

Initiate a dispute with your bank and submit any relevant screenshots, chat logs, or emails. Word of warning: cryptocurrency transfers are not protected.

How Long Does It Take for Banks To Refund Scammed Money?

If you paid a scammer via debit card:

- Federal law requires banks to investigate disputed charges within 10 days of receiving a complaint [*].

- For a new account that has been opened in the past 30 days, the bank has 20 business days to investigate.

- The bank must send a provisional credit to your account within 10 days and has up to 45 days to complete the investigation.

- If the bank determines that a charge was fraudulent, it must refund your money and remove the charge from your account [*].

If you paid a scammer with a credit card:

- Your card issuer must acknowledge your dispute within 30 days.

- After receiving your dispute letter, the credit card company has 90 days to resolve your issue [*].

- The company must notify you in writing of its decision with a full explanation. If you disagree with the results, respond within 10 days.

What To Do If the Banks Won’t Give You a Refund

If your bank rejects your claim, don't lose hope. Encourage the bank to refund scammed money:

Send a written dispute letter to your bank

Include any evidence that supports your claim, such as an FTC report, receipts, or emails from the scammers. Keep a copy of the letter for your records.

Follow up with your bank

If there are any developments about your case, send them to the bank to stay top of mind.

Submit complaints to government agencies

If the Consumer Financial Protection Bureau (CFPB) finds that your bank did not follow proper procedures or violated any laws, the bureau may take legal action. You can submit a complaint by:

- Completing the online form.

- Calling 855-411-CFPB (2372).

Banks typically respond to the CFPB within 15 days. You have 60 days to review the issuer’s response and send feedback.

If you’re still dissatisfied, contact your bank’s regulator. You can find this contact information by using the Federal Financial Institutions Examination Council (FFIEC)’s lookup tool.

Contact law enforcement

Filing a police report is especially helpful if you believe that the thief is in the local area. Bring your FTC report and all supporting evidence when you go to the police station.

📚 Related: How To Contact The Police About Credit Card Fraud →

Don’t Let Thieves Take Off With Your Funds

Last year, a Bay Area school teacher received a call from someone she thought was a Wells Fargo representative and was told to wire money to “stop a fraudulent charge” [*]. Another San Francisco resident got a text message from a fake Wells Fargo representative who convinced her to pay for a replacement debit card [*].

The best way to avoid these financial disasters is to prevent them from happening in the first place.

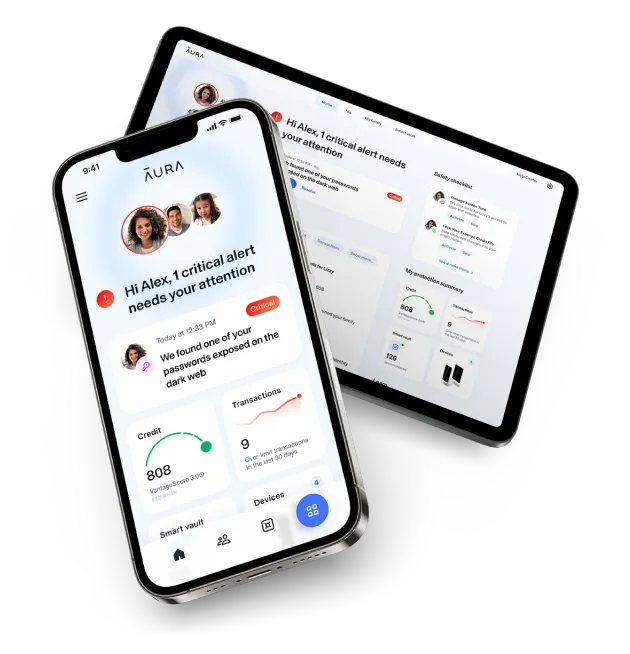

Digital security apps like Aura provide coverage on all sides — alerting you to suspicious activity and protecting you from identity theft, credit card fraud, phishing scams, and more.

Keep your bank account safe from scammers. Try Aura free for 14 days.

Editorial note: Our articles provide educational information for you to increase awareness about digital safety. Aura’s services may not provide the exact features we write about, nor may cover or protect against every type of crime, fraud, or threat discussed in our articles. Please review our Terms during enrollment or setup for more information. Remember that no one can prevent all identity theft or cybercrime.