In this article:

How To Avoid the 14 Latest Venmo Scams [2024 Update]

Venmo is fast and easy to use. But is it safe? Here’s a list of the latest Venmo scams you need to watch out for and how you can keep your money safe.

Do You Know How To Spot a Venmo Scam?

When an Oklahoma woman reached out to a dog breeder online, she thought she’d found the perfect pet for her family. Instead, she ended up losing almost $1,000 to a Venmo scam after being tricked into sending multiple deposits to both the supposed breeder and a fake "delivery" company [*].

Venmo — and other payment apps like Zelle or Cash App — are convenient ways to send and receive money. But what most people don’t realize is that they lack the same level of fraud protection you get when using other payment methods.

According to the latest Better Business Bureau (BBB) Online Purchase Scam Report [*]:

Victims of Venmo scams lost an average of $700 — the second highest of all payment services.

If you’re using Venmo to pay for goods and services, you need to be cautious. In this guide, we’ll review the most common Venmo scams, how they work, and how you can protect yourself.

{{show-toc}}

What Are Venmo Scams? Is Venmo Safe?

Venmo scams are schemes that trick Venmo users into sending scammers money or personal information, such as bank account details or Social Security numbers (SSN).

While Venmo is mostly safe to use (if you follow certain precautions), Venmo users have become attractive targets for scammers for a few reasons.

First, Venmo transfers appear almost instantly — but aren’t normally verified for a few days. This makes it harder for banks to catch scammers who are using stolen credit cards or bank accounts. If the real user files a credit card or fraud claim, the money sent to the scammer cannot be recovered.

Second, Venmo is also more anonymous than other money transfer apps. Scammers can create fraudulent accounts or pose as legitimate users and request money. (That’s why Venmo suggests that you only use it for sending money to people you know.)

While there are many types of Venmo scams, they typically follow one of these patterns:

- Overpayment or mistake payment scams: A person “accidentally” sends you too much money for an online payment and asks for a refund. But in reality, they’ve used a stolen credit card or bank account to make the transfer.

- Impersonator scams: A person impersonates one of your friends and asks you to send them money.

- “Free” money scams: A fraudster sends you a message claiming you’ve won free money on Venmo and you need to provide your bank details to receive the money.

- Fake Venmo employee scams: You receive a phone call or email from someone claiming to work at Venmo who asks for your information to “help” you.

The scary truth is that peer-to-peer payment apps like Venmo have fraud rates three to four times higher than credit cards [*]. Before you send anyone money on Venmo, make sure you know the latest scams.

The 14 Latest Venmo Scams To Know

- “Mistake” money transfers

- Fake friends requesting help

- Scammers selling hard-to-find items

- Fake payment invoices from Venmo

- Overpayment from online purchases

- Fake emails or texts

- Strangers who ask to use your phone

- “Money circle” investment scams

- Fake prizes and rewards

- Scammers posing as Venmo support agents

- Fake Venmo websites

- Job scams

- Sending fake checks

- Romance scammers asking for “gifts”

Venmo scammers are always adapting their schemes. But if you see the warning signs of any of these Venmo scams, be careful.

1. “Mistake” money transfers

The “mistake” money transfer looks harmless on the surface. A scammer sends you money on Venmo, then sends you a message claiming it was a “mistake” and asks for a refund [*].

What’s really happening is that scammers sent you money with a stolen credit card. Then, before you refund them, they update their Venmo account with their own banking details. As a result, you refund them — not the stolen credit card.

When the real credit card owner reverses the charge, Venmo takes the money from your account, as Venmo doesn’t offer any built-in fraud protections.

Don’t fall for this scam. Do this instead:

- Ignore any unexpected transfers — especially if senders ask you to refund them. Don’t reply to the scammers. Some targets have reported that the fraudulent transactions disappear on their own [*].

- Don’t deposit mistaken transfers into your account, as you’ll be responsible for that amount when the real victim reports the fraud.

- If in doubt, contact Venmo and ask them to verify or possibly reverse the transaction. You can also block Venmo users who send unsolicited payments or requests.

2. Fake friends requesting help

Con artists have introduced some classic impersonator scams to Venmo. In this one, fraudsters change their profile picture and information to impersonate someone you know.

Then, they message you requesting money for an “urgent” matter — such as paying for medical treatment, lawyer fees, or something similar [*].

Scammers can find out enough about you to convince you to send them money just by looking at your social media profiles, public Venmo transactions, and online footprint.

In some cases, scammers may even hack your friend’s phone or account and use that real profile to request money. But instead of the money going to a friend, it goes to the scammer.

Don’t fall for this scam. Do this instead:

- Use common sense. If the tone or language of the message seems out of character for your friend, trust your intuition.

- Contact any friends or family members who are asking for money unexpectedly to verify that they actually sent the request.

- Keep your Venmo privacy settings updated so that your transactions are private and not shared in the public feed.

3. Scammers selling hard-to-find items

Finding hard-to-get items like popular gaming consoles or concert tickets can be frustrating. You might be tempted to buy directly from a stranger instead of buying from an official online store or retailer.

Unfortunately Venmo doesn’t offer you any type of fraud protection if these transactions go wrong — and scammers know it.

In these Venmo scams, fraudsters post in-demand products on platforms like Facebook Marketplace. When you reach out, they’ll insist that you use Venmo to make the purchase so they won’t have to pay a fee. But once you send them the money, the “seller” disappears along with the product that you thought you’d purchased.

In another version of this scam, a buyer will send you an email that looks like it’s showing an official Venmo payment. These emails will often claim that Venmo is holding the money until you upload the item’s shipping information. But this isn’t a feature that Venmo offers, and the whole email is part of the scam.

Be aware that these scams can also happen when you sell items online.

A fraudster will fund their Venmo account using a stolen credit card to pay for your item. But once you ship it out, the fraud will be discovered and you’ll be required to pay back the stolen money — leaving you robbed of cash and the item you wanted to sell.

Don’t fall for this scam. Do this instead:

- Don’t use Venmo for buying items from people online. If you don’t know them personally or can’t meet up in person to receive the item, you could get scammed.

- Only purchase from approved Venmo business accounts. These accounts will say “Eligible items covered by Purchase Protection” under the “Pay” button.

- Make sure any email you get comes from an official “Venmo.com” email address. If it doesn’t, it’s a scam.

💡 Related: Buying Tickets Online? Watch Out For These Ticketmaster Scams →

4. Fake payment invoices from Venmo

In another version of the online shopping scam, a buyer will send you an email that looks like it’s showing an official Venmo payment. These emails will often claim that Venmo is holding the money until you upload the item’s shipping information. But this isn’t a feature that Venmo offers, and the whole email is part of the scam.

Be aware that these scams can also happen when you sell items online.

A fraudster will fund their Venmo account using a stolen credit card to pay for your item. But once you ship it out, the fraud will be discovered and you’ll be required to pay back the stolen money — leaving you robbed of cash and the item you wanted to sell.

Don’t fall for this scam. Do this instead:

- Don’t believe any claim that Venmo is “holding” money for you until you send an item. This is a lie.

- Wait to verify the payment in your Venmo account before sending any items to a buyer.

- Make sure any email you get comes from an official “Venmo.com” email address. If it doesn’t, it’s a scam.

5. Overpayment for online purchases

Overpayment scams are similar to mistaken money transfers. In this scam, fraudsters “accidentally” overpay for an item you have for sale.

Unfortunately, after you refund the “extra” amount, you discover that the initial payment was fake. So, now you’ve lost the money you sent because you never actually received the overpayment.

Furthermore, the initial payment was likely made with a stolen credit card, which leaves you responsible for the lost money.

Don’t fall for this scam. Do this instead:

- Don’t use Venmo to sell items to strangers — especially if you aren’t able to meet in person.

- Contact Venmo’s customer service if someone overpays you for an item. Let them know you’re afraid it’s part of a scam. Document the call, and include which customer service representative you’re talking to, the date, and time.

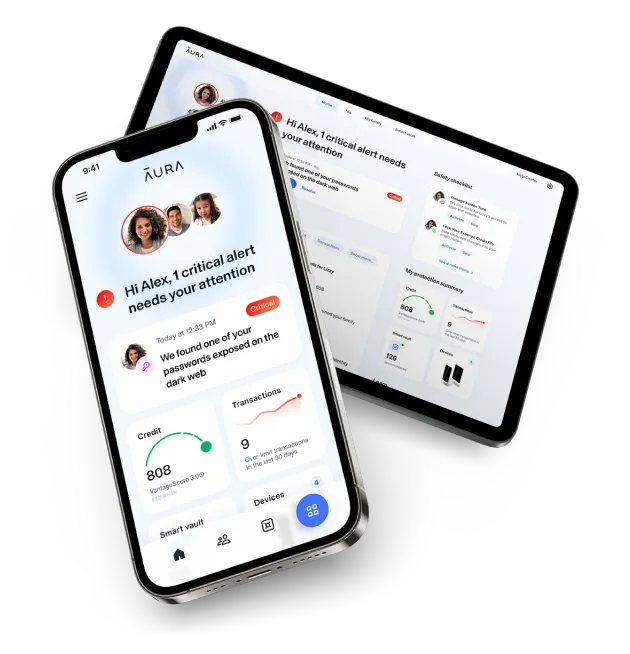

Pro tip: Sign up for a credit and transaction monitoring service. Aura monitors your bank and credit card accounts for signs of fraud and suspicious activity. This way, you can shut down scammers before they do too much damage.

6. Fake emails and texts claiming to be from Venmo (Phishing attacks)

In a phishing attack, you’re sent emails from scammers claiming to be from legitimate businesses, including Venmo.

The scammers replicate as many details of an actual Venmo email as they can, such as Venmo’s colors, logo, and even a similar domain name (i.e. instead of joe@venmo.com, they might use joe@venma.com) [*].

The email will request that you click on a link and verify your personal and financial information (which the scammers can use for identity theft or fraud).

Scammers will also use social engineering tactics to pressure you into acting quickly. For example, one scam message may claim that your Venmo accounts will be charged if you don’t click on the link in the text.

A “smishing” attack is similar, except that you receive a fake text message instead of an email. The text message will appear legitimate, using cues to make you think it’s from Venmo.

Don’t fall for this scam. Do this instead:

- Don’t click on links from emails or texts that claim to be from financial institutions or Venmo, as these are likely scams.

- Contact the business that’s being impersonated in the scam to inform them, and then delete the email or text.

- If you’re concerned your Venmo account will be closed or charged, don’t click on a link. Instead, call Venmo customer service.

- Always check emails for signs of a phishing scam — e.g., the email doesn’t come from an official “Venmo.com” email address or includes strange links and attachments.

💡 Related: Was Your PayPal Account Hacked? Here's What You Can Do →

7. Strangers who ask to use your phone

In this scam, fraudsters will approach you in public and ask to use your phone for an emergency. They’ll try calling someone and then claim the person they’re calling isn’t picking up, so they ask to send a text from your phone. But instead, they open your Venmo account and send transfers to themselves.

This exact scam happened to a Florida woman when a young boy claimed to be lost and asked to use her phone to call his parents [*].

Even though the boy was just a few feet away from her, the woman didn’t see him open her Venmo app. But a few days later, she received a notification that two Venmo charges were approved — one for $1,800 and one for $2,000.

Don’t fall for this scam. Do this instead:

- Don’t lend your phone to anyone you don’t know — even children. Instead, offer to contact someone for them, such as the police. Or, if children approach you about being lost, walk with them to a nearby shop or business where they can call and wait for their parents.

- Lock your Venmo account with a PIN or Touch ID. This way, only you should be able to access your account on your phone.

8. “Money circle” investment scams

Scammers use common “get rich quick” schemes on Venmo to try and steal your money. In this scam, a fraudster — either a stranger or someone you know — asks you to send them a small amount of money on Venmo in return for a larger amount later (usually after you bring more people into the “circle”).

Unfortunately, the money never appears and you’re out your initial investment.

Another version of this money circle scam occurs with gift cards. You send the scammer a small amount of money for a gift card. Then, the scammer promises to send you a much larger gift card. Only you never receive it.

Don’t fall for this scam. Do this instead:

- Remember the golden rule of fraud prevention: If it seems too good to be true, it probably is. Don’t trust any “investment” that guarantees a return.

- Only send money on Venmo to people you know and trust.

💡 Related: The 14 Cash App Scams You Didn't Know About (Until Now) →

9. Fake prizes and rewards

In this common Venmo scam, you receive an email or text claiming that you’ve won “free money” on Venmo. To receive it, all you have to do is click on a link and sign into your Venmo account.

But the link is fraudulent; and instead, you’ll be sent to a phishing site that steals your Venmo account and password.

Another version of this scam involves receiving an email or text that claims you’ll get a Venmo gift card for completing a survey [*].

While sometimes businesses will offer you a gift card for answering survey questions, legitimate companies wouldn’t use Venmo to do this, as it doesn’t comply with their user agreement.

Don’t fall for this scam. Do this instead:

- Be wary of any message that claims you’ve won a prize — especially if you never entered a contest. Delete these emails and ignore any texts.

- Check that any email comes from an official “Venmo.com” email address.

- Never share your Venmo login or account information with anyone in a text message or email.

- If you’re unsure if an offer is legitimate, check by contacting Venmo’s customer support.

💡 Related: 10 Text Message Scams You Didn't Know About (Until Now) →

10. Scammers posing as Venmo support agents

In this variation of a common bank scam, fraudsters contact you and pretend to be from Venmo’s customer support team. They’ll claim there are “unauthorized” transactions on your account, and that you need to “verify” your account to keep it safe.

In reality, fraudsters are trying to steal your login information (password and 2FA code) to gain access to your account.

Don’t fall for this scam. Do this instead:

- If someone contacts you claiming to be from Venmo’s customer support team, ignore the message or hang up and then contact the company directly from the app.

- Never provide two-factor authentication (2FA) codes to anyone. Venmo’s support team will never ask for these.

11. Fake Venmo websites with fraudulent contact information

Scammers may also create fake websites in the hopes that you’ll contact them for “help” with your Venmo account.

If you call, they’ll tell you that there are issues with your device or account and that you need to pay to upgrade to “premium” support. They’ll ask you to use Venmo to pay them before they can help you.

Don’t fall for this scam. Do this instead:

- When you need technical support, go to a company’s official website and find their phone number or contact information. Don’t just rely on what comes up when you Google their name and “customer support.”

- Don’t pay for tech support using Venmo. A legitimate business would either not ask for payment at all, or (if payment is required) have you pay by using methods designed for businesses.

💡 Related: The 7 Latest Geek Squad Scams (and How To Avoid Them) →

12. Job scams asking you to send money via Venmo

Job scams all follow the same steps:

- Scammers post an ad for a job or reach out to you over social media.

- They “interview” you briefly via platforms such as Messenger, Telegram, or WhatsApp. This is because the scammer is usually operating out of another country; hopping on a phone or video call would be a dead giveaway that they are trying to scam you.

- Next, you receive a new job offer. You are then asked to pay a fee upfront for onboarding or setup — using Venmo.

Sometimes, they might ask you to help transfer another employee’s money using your Venmo account, and you become an “accidental money mule.”

Regardless of the exact scenario, any of these cases will end with you still jobless — and with less money in your wallet.

Don’t fall for this scam. Do this instead:

- Look for the warning signs of a job scam — for example, an offer that’s too good to be true, or an “employer” that will only contact you via platforms such as Messenger or Whatsapp.

- Don’t pay for “onboarding” or for new job materials unless you’re 100% sure that the job is legitimate.

13. Sending fake checks (and asking for a refund via Venmo)

Venmo scammers will sometimes reach out to you about an item you’re selling, and ask if they can send you a check. The check will often be for more than the asking price, and they’ll ask you to refund the “extra” money to their Venmo account.

When you first cash the check, it likely will clear your bank. But then later, it will bounce. You’ll end up having to pay your bank in addition to losing the money that you “refunded” the scammer.

Don’t fall for this scam. Do this instead:

- Never exchange a paper check for a Venmo payment. This is a clear red flag indicating a scam.

- Look for the warning signs of a bank scam when dealing with strangers on Venmo.

14. Romance scammers asking for “gifts”

In romance scams, fraudsters create fake profiles and pretend to be a love interest. They use techniques like love bombing to win your affection and then manipulate you into sending them gifts or monetary “help” via Venmo.

For example, they might claim that they want to come see you — but they need help paying for the plane ticket.

Whatever story they give you, the result will be the same. Once you send the money, they’ll continue asking for more or disappear completely.

Don’t fall for this scam. Do this instead:

- Don’t send money to people you’ve only met online — especially if it’s only over a dating app or text conversations.

- Be aware of the warning signs of an online dating scam. If they seem “too perfect” or can never meet in-person or even over video chat, they’re probably a scammer.

Scammed on Venmo? Here's What to Do

While Venmo makes it simple and convenient to send money to family and friends, it can leave you vulnerable to identity theft and fraud if you don’t take the proper precautions.

If you believe you have been scammed, stop all contact with the scammer. Then, follow these steps for the best chance of minimizing the damage and getting your money back:

- Report the scam to Venmo’s security support immediately. Here’s how to get in touch with Venmo about an unauthorized transaction: If you’ve received a fake Venmo email, you can forward it to phishing@venmo.com. If you receive a fake text, email a screenshot of the text to support@venmo.com. Then delete the email or text from your account.

- Try to get your money back. Follow these steps to try and get your money back if you've been scammed on Venmo.

- Update your Venmo password (and any other compromised accounts). Choose a secure and unique password, and enable two-factor authentication (2FA) on your account. You should also consider using a password manager to keep all of your accounts safe.

- Report the fraud to the Federal Trade Commission (FTC). The FTC has resources for victims of fraud at IdentityTheft.gov. If you try to recover lost funds, you’ll most likely need an FTC report to do so.

- Contact your bank and let them know about the fraud. This step is especially important if the scammer has gained access to your bank information, SSN, or other personal information.

- Look for the warning signs of identity theft. Scammers can do serious damage if they gain access to your personal information. If your identity has also been compromised as part of the scam, follow the steps outlined in our identity theft recovery guide. For the most secure protection, consider an identity theft protection service like Aura.

Can You Get Your Money Back?

If you send money to a stranger or get scammed on Venmo, you’re unlikely to get your money back.

Unlike credit or debit cards that have fraud protection and chargeback systems in place, Venmo treats your money more like cash.

In fact, you’re more likely to recover stolen funds if you use a payment service like PayPal instead of Venmo [*].

However, this doesn’t mean you’re completely out of luck if you get scammed. If you send a Venmo transfer to an authorized business, or mark a payment to a personal profile as a purchase, you may be covered by purchase protection [*].

💡 Related: Zelle Scams and How Thieves Are Siphoning Away Your Money →

How To Protect Yourself From Venmo Scams

The best way to protect yourself from Venmo scams is to only exchange payments with people you trust and know personally. But if you need to use Venmo in other situations, you can still do so safely by following these tips:

- Link your credit card to your Venmo account — not your bank account. In the event that something happens, it’s far easier to cancel a credit card (and file a chargeback) than try to recoup the damages from your bank.

- Update your privacy settings on Venmo so that all transactions are private. All of your friends don’t need to know that you sent your roommate $65 for the utility bill this month.

- Only use Venmo with people you know and trust. Treat Venmo transfers like cash — once they’re gone, it’s nearly impossible to get it back. If you receive unexpected requests or payments from people you know, contact them directly and confirm that they are the actual senders.

- Never accept payments from people you don’t know. Report and block any account that randomly requests money from you.

- Don’t ship or give an item to the recipient before you’ve received payment and can confirm the transaction is legitimate.

- Question offers that seem too good to be true because they are likely scams.

- Don’t give your personal information to anyone, including people who claim to be from Venmo.

- Regularly check your credit report and bank statements. Venmo scammers are almost always after access to your financial accounts. An identity theft protection service like Aura can monitor your credit report and bank statements for you and alert you to any signs of fraud.

- Don’t click on links or attachments in suspicious emails or texts. Scammers often hide malware or links to fake websites in phishing emails and texts.

- Don’t let anyone use your phone. Anyone with access to your phone could potentially compromise your Venmo and other accounts.

- Set up multi-factor authentication (2FA or MFA). This way, Venmo has to send you a code to verify a login on an unfamiliar device.

- Consider signing up for identity theft protection. Aura’s top-rated identity theft protection monitors all of your most sensitive personal information, online accounts, and finances for signs of fraud. If a Venmo scammer tries to access your accounts or finances, Aura can help you take action before it’s too late. Try Aura’s 14-day free trial for immediate protection while you’re most vulnerable.

The Bottom Line: Stay Safe on Venmo

Venmo can be a convenient way of sending money to people you know. But when you use it for other purposes — like buying and selling items online — you put yourself at risk of scams.

Protect yourself and your money from Venmo scammers by being vigilant, double-checking every transfer, and never sending money to people you don’t know. And to keep your account and identity safe, sign up for Aura.

Keep your money safe from scammers — try Aura free for 14 days.

Editorial note: Our articles provide educational information for you to increase awareness about digital safety. Aura’s services may not provide the exact features we write about, nor may cover or protect against every type of crime, fraud, or threat discussed in our articles. Please review our Terms during enrollment or setup for more information. Remember that no one can prevent all identity theft or cybercrime.