In this article:

The 12 Latest Scams You Need To Avoid (2024)

This year is shaping up to be one of the worst ever for online scams, cybercrime, and fraud. Stay safe by knowing the latest scams making the rounds.

These Are The Biggest Scams of the Year

Kelly Reynolds was relaxing at home when she received a text from her bank asking if she had tried to send money via Zelle. Alarmed, Kelly responded “no” — within seconds, her phone rang, and the caller ID showed “Wells Fargo Fraud Protection.”

The agent instructed Kelly to transfer her savings to a new, secure account — but Kelly was skeptical. She quickly did an online search to verify the agent’s name and phone number. When everything checked out, Kelly hit “send” for her transfer — and lost her life savings to a scam [*].

According to the Federal Trade Commission’s (FTC) latest data [*]:

Victims lost over $6 billion to cybercriminals in the first nine months of 2023 alone.

But what’s even more surprising is that Gen Xers, Millennials, and Gen Zs were more likely than seniors to report losing money to fraud [*].

Suffering financial loss from fraud, scams, and identity theft is devastating. The ugly truth is that fraudsters are always looking for new ways to scam you. To stay safe, you need to keep up to date with the latest scams going around — and learn how to avoid them.

{{show-toc}}

The 12 Latest Scams You Need To Know

- The “pig butchering” scam

- Student loan forgiveness scams

- Damaged used cars sales

- Google Voice verification code scams

- Zelle, Venmo, and Cash App Scams

- Robocalls attempting to steal 2FA codes

- Work-from-home scams

- Amazon imposter scams

- Crypto recovery services

- Tech support scams

- Rental apartment and home scams

- Fraudsters posing as your friends

The latest types of scams can happen via phone calls, text messages, emails, social media, or even in person. Learn to recognize the warning signs so that you can keep yourself and your family safe from fraudsters.

1. The “pig butchering” scam (fake crypto investments)

This year, cybercriminals started playing the long game. In “pig butchering” scams, what begins as a chance online encounter or wrong number text slowly turns into a romance scam.

The fraudster “fattens the pig” by building trust over time, eventually luring the target into a financial trap — the “butchering” phase, during which the victim loses everything.

Pig butchering scams are often connected to cryptocurrency, though scammers can use any investment scheme.

How the scam works:

- Scammers reach out via text, social media, or dating websites and start to build a relationship (whether friendly or romantic).

- Eventually, the scammer starts talking about how much money they’ve earned on their “secret” or “exclusive” cryptocurrency investments.

- They convince their target to try a small investment on their “special” app or platform (which is really just a bogus website that steals the victim’s money).

- The scammer makes it look like the investment was successful, and encourages the target to keep investing and earning.

Here’s how to stay safe:

Be suspicious of any stranger on the internet who initiates a close personal relationship with you out of the blue. Cut off all contact if someone starts pressuring you into making risky investments, such as via cryptocurrency — especially if they promise “guaranteed” returns.

⛳️ Related: Is Coinbase Safe? How To Protect Your Cryptocurrency →

2. Student loan forgiveness scams

Whenever a government relief program hits the headlines, scammers get to work. One of the most highly-publicized relief initiatives in the past year, to which scammers have flocked, has been President Biden’s student loan forgiveness program.

How the scam works:

- Scammers communicate via phone calls or emails. They use generic business names that sound trustworthy, or they pose as federal loan servicers and set up a phony website that looks official.

- They might offer various services, from loan consolidation help to loan forgiveness. They claim they can speed up the loan repayment process or lower monthly payments (for a fee). One recent victim lost $600 to a scam like this one [*].

- If a target falls for the fraudulent offer, they unwittingly disclose sensitive information to a criminal — including details like their Social Security number (SSN), IDs, financial information, or whatever else the scammer requests on the fake application form.

Here’s how to stay safe:

Avoid speaking with anyone who contacts you claiming to be your loan servicer. Instead, hang up the phone and contact your loan servicer directly, using the contact information from your billing statement, the provider’s official website, or your own address book.

3. Damaged used cars selling for sky-high prices

Used car prices hit historic highs in 2021 and 2022 — offering huge opportunities for scammers [*]. If you’re shopping for a used car, it can be difficult to determine whether it’s actually in good condition. Dishonest sellers tamper with the vehicle’s identification number (VIN) or car title, or they hide serious issues like water damage that affect the value of the car.

How the scam works:

- In one type of car scam, sellers charge high prices for cars that have endured extensive water damage. Scammers can clean up a flood-damaged car and lie to the buyer about its history.

- Title fraud is another common way that scammers fool unsuspecting buyers. They’ll sell a salvage title vehicle for the price of one with a pristine record by forging or altering the car title document in a way that the buyer doesn’t detect.

Here’s how to stay safe:

Thoroughly inspect the vehicle title, and compare it to a legitimate one to check for signs of forgery.

Beware of cars being sold from out of state or with a recently-issued title. It’s also ideal to pick the Department of Motor Vehicles (DMV) as your meet-up location. That way, you can double-check the validity of the vehicle documentation and history, as well as the seller’s driver’s license information.

4. Google Voice verification code scams

One of the most common scams targeting Americans in the past year involves fraudsters trying to gain access to private Google Voice verification codes. If they’re successful, they can use your Google Voice number to run scams, break into your other online accounts, or even harvest more information to steal your identity.

How the scam works:

- Fraudsters use social media or online marketplaces to pose as an interested buyer or someone who’s found a lost pet. The scammer uses your phone number listed in the ad to start setting up a Google Voice account.

- Next, the scammer tells the target that they’re about to send them a verification code for “security reasons.” This is a classic double-scam ploy in which the scammer acts as if you’re the one who they should be worried about.

- Google automatically sends a private authentication code to the victim’s phone number as part of the Google Voice account setup process. When the target shares it, the scammer can begin using a new phone number that isn’t connected to their identity.

Here’s how to stay safe:

Thankfully, the solution to avoiding this scam is pretty simple: Don’t ever share a Google Voice verification code with anyone. It’s meant for you and only you, and there’s no good reason for anyone else to have it.

5. Zelle, Venmo, and Cash App scams

Unlike purchases made directly through your bank account using your credit card or debit card, payment app transactions are usually irreversible. If you accidentally pay a scammer via Zelle, Venmo, or Cash App, it’s the same as handing them cash.

Here are some of the most common payment app scams:

- Accidental overpayments. Fraudsters target online sellers by posing as a buyer and “accidentally” overpaying the seller on a payment app by using a stolen credit card. They then request a refund paid directly to their own bank account. But when the actual card owner reports the fraud, the money comes out of your account.

- Fake fraud alerts. Scammers send spoofed text messages that look like your bank’s fraud alerts. But when you call the number in the text, you’ll be connected to scammers who pressure you to share personal information or transfer your money to a “secure” account (that they control).

- Phishing emails or texts. Hackers create phishing emails or texts that look like they’re from Zelle, CashApp, or Venmo. These messages prompt you to click on a link to sign in to your account. But in reality, the link takes you to a fake website that steals your login credentials and gives scammers control of your online accounts.

Here’s how to stay safe:

Treat all online transactions like cash, and don’t use payment apps for online transactions with strangers. When you get a message that looks like it’s coming directly from a payment app company, verify it by first logging in to your account using the official app or website.

⛳️ Related: Wells Fargo Customer? Beware Of These 6 Scams →

6. Robocalls attempting to steal 2FA codes

This scam preys on people who hold cryptocurrency in an exchange like Coinbase. It offers the promise of helping safeguard the victim’s assets — but in reality, it does just the opposite.

How the scam works:

- You get a robocall claiming to be from the fraud prevention department of your cryptocurrency exchange. It claims there’s an unauthorized charge on your account.

- The automated call asks you to “verify” your identity by entering a two-factor authentication (2FA) code that’s been sent to your phone.

- Behind the scenes, a scammer has hacked into your account and needs only this code to gain complete access to your assets. If you share the code, the scammer will take over your account and drain it.

Don’t get scammed! Here’s how to stay safe:

Never share two-factor authentication codes with anyone for any reason, even if the situation seems legitimate. No cryptocurrency exchange will ever call and ask for your password or 2FA code.

⛳️ Related: The Best Identity Theft Protection for Seniors (2024) →

7. Job scams (work-from-home scams)

A common COVID-19 scam involves fake job postings for lucrative work-from-home jobs. In these schemes, fraudsters pose as recruiters and fool victims into providing personal information or sending money to pay for “supplies and training.”

According to the Federal Trade Commission (FTC), Americans lost a collective $68 million to employment scams during the first quarter of 2022 [*].

How the scam works:

- Fraudsters create fake job listings that offer attention-grabbing perks. Scammers impersonate recruiters or employers, and reach out directly to users on job websites like LinkedIn.

- When someone accepts the job, scammers collect sensitive information like the victim’s credit card numbers or account information, Social Security numbers (SSNs), and other sensitive documents that can be used to commit identity theft.

- Victims of job scams are often prompted to make payments for expenses like job training or supplies — requests that a legitimate company would never make.

Here’s how to stay safe:

Do your research before getting too far into the interview process with a potential employer. Search for the name of the business or recruiting company on the Better Business Bureau (BBB), as well as on job rating and review websites like Glassdoor.

Finally, never give a recruiter your personal or financial information via email, text message, or phone call.

8. Amazon impostor emails, calls, texts, and more

Of all the well-known businesses out there, Amazon inspires the largest number of impostor scams. Since it’s a powerhouse online retailer with a vast customer base, most people won’t think twice when they receive a communication that looks like it’s from Amazon.

How the scam works:

- Fraudsters create phishing emails or texts that impersonate Amazon customer service agents or include security alerts. They fool targets into responding or clicking on malicious links that infect their devices with invasive malware.

- Amazon phone scams convince victims to share personally identifiable information (PII) over the phone or make payments to resolve a fake issue or bogus security concern.

- Some internet criminals create Amazon lookalike websites (that trick people into entering their payment information) or bait their targets by sending fake Amazon invoice emails for items that they didn’t purchase.

Here’s how to stay safe:

Ignore unsolicited emails or text messages from Amazon, and never use the links or phone numbers they include. If you have any concerns about your account or order history, navigate directly to your Amazon app or the official Amazon website, and call the customer service phone number to get answers.

9. Crypto “recovery” scams (and other refund scams)

This popular scam targets people who have already lost money in a cryptocurrency scam. Fake crypto recovery services promise a quick fix to the devastating loss — but the only result is more money lost in a scam tailored to prey on previous victims.

How the scam works:

- After falling victim to a cryptocurrency scam, you share your story online to warn others or look for solutions.

- Someone reaches out over social media or in the comments section of your post and claims to be able to recover stolen cryptocurrency.

- To process your “refund,” they’ll ask you to pay an upfront fee (then disappear with your money) or request sensitive information that gives them access to your crypto wallet.

Here’s how to stay safe:

If you’ve lost cryptocurrency in a scam, it’s essentially impossible to get it back. Ignore messages from anyone who claims to be able to get a refund. They will only scam you out of more money.

10. Tech support scams that gain remote access to your computer

Scammers know that most people are afraid of getting hacked or having their computer or phone infected with viruses. In this scam, they trick you into thinking your device has been compromised and then pressure you into downloading software that gives them remote access to your computer.

How the scam works:

- Scammers send an alarming phishing email, text message, or even pop-up ad declaring that your device has been hacked or infected.

- The tech support phone number provided in the alert is a direct line to the scammer. Once they get you on the phone, they request remote access to your device in order to “fix” the nonexistent problem.

- When they gain access, they install invasive malware, spyware, or even ransomware onto your device. They can also use hacking techniques to steal sensitive data from your hard drive — such as personal and financial information, usernames, and passwords.

Here’s how to stay safe:

If you get a troubling message from a tech support team, don’t click on links or respond via any contact information listed in the message. Contact Apple, Microsoft, or your antivirus provider by using their official websites or phone numbers.

11. Rental apartment and home scams

With more Americans moving because of the pandemic, fraudsters have created new ways to scam renters. Scammers create fake listings and duplicate ads, and then steal money for deposits or “fees.”

In one example, a family from North Carolina replied to a rental listing and paid their first month’s rent — only to arrive at the location and discover that the home was never actually for rent [*].

How the scam works:

- Scammers create fraudulent home or apartment listings depicting photos of a rental unit that doesn’t belong to them. They keep the listing prices below market rates to attract attention from potential renters.

- When apartment hunters show interest, the scammer tries to get them to make a payment before meeting up or seeing the unit in person.

- The scammer disappears once the payment goes through, leaving the victim to discover that they don’t have a new place to live after all.

Here’s how to stay safe:

Avoid listings that look too good to be true. Always insist on an in-person meetup and tour of the unit, and don’t make any payments beforehand (or before signing a lease agreement). Finally, never agree to use nontraditional payment methods like wire transfers or payment apps.

12. Fraudsters using your friends’ online accounts to scam you

If any of your personal contacts fall victim to account takeover fraud or a data breach, you might get a strange request from someone you think you know. In reality, it’s a hacker impersonating your friends or family members by using their personal accounts or spoofing their social media profiles.

One woman from California recently lost hundreds of dollars after a “friend” on Facebook convinced her to sign up for a special program with amazing benefits [*].

How the scam works:

- Fraudsters hack into or copy your friend’s social media account, email address, phone number, or even payment app platform.

- They reach out via social media, email, text message, or direct message, pretending to be the account owner. They ask you to send them money or gift cards to help them out of a tight situation.

Here’s how to stay safe:

If someone you know is acting pushy or asking for money out of the blue, never take it at face value. Don’t click on links or continue the conversation — instead, try either calling them directly or contacting them on a different platform.

How To Spot a Scammer in 2024

Although online scams are getting more sophisticated every year, most online con artists recycle the same social engineering strategies repeatedly. With enough information and vigilance, you’ll be able to recognize new scams that you’ve never seen before.

Here are the most common red flags to look out for:

- A strong sense of urgency. Scammers fabricate high-pressure situations like time-sensitive security alerts, urgent messages, or a limited-time offer for an amazing sweepstakes prize. These scams are designed to make you feel rushed and stressed out. The moment you feel that pressure, take a step back and reevaluate.

- Threats or scare tactics. Scammers often use fear to get you to act. They may call pretending to be law enforcement and threaten arrest, deportation, cancellation of your Social Security number, or some other dramatic consequence. Legitimate government agencies don’t do this.

- Sob stories and excuses. Whether you’re buying and selling online, trying to find an apartment to rent, or looking for companionship on a dating platform, beware of anyone who uses a sob story or excuse to ask for money, avoid meeting in person, or request nontraditional payment methods for a purchase. They’re probably trying to win your sympathy so they can swindle you.

- Calls or messages from authoritative or trustworthy organizations. The sooner scammers can establish trust or claim authority, the faster they can steal from you. They impersonate representatives from your credit card company, a well-known organization like Google or Microsoft, or a government agency like the IRS or Medicare. Don’t give away any information or click on links before verifying the source elsewhere.

- Asking for sensitive information. It’s not common practice for a legitimate agency or business to contact you out of the blue and request sensitive personal details or have you “confirm” payment information — but this is the bread and butter for all kinds of phishing scams.

- Insisting on nontraditional payment methods. Using payment apps, gift cards, or wire transfers as payment for an online transaction with a stranger is extremely risky. Scammers prefer these payment methods because they’re immediate, irreversible, and lack the security of transactions made via credit and debit card.

Don’t Become a Victim: Here’s How To Protect Yourself From Scammers

There are few worse feelings than realizing you’ve been the victim of a scam. But fraudsters in 2024 know that your personal information can be even more valuable than money.

Don’t wait for scammers to pounce. You can significantly reduce your chances of being victimized by a scam — but you have to think proactively. Here’s what to do:

- Freeze your credit with all three credit bureaus (Experian, Equifax, and TransUnion). A proactive credit freeze is an easy way to prevent fraudsters from opening up new lines of credit or accounts in your name.

- Update your passwords, and enable two-factor authentication (2FA) whenever possible. Visit the settings menu in all of your accounts and apps, and choose the most secure options. Use a password manager to generate and store secure passwords.

- Learn to recognize the signs of a phishing email, text message, or phone call.

- Don’t refund overpayments. “Accidental” overpayments indicate a scam. Instead of issuing a refund, cut off contact and wait for the fraudulent payment to disappear (since the scammer never really sent you money in the first place).

- Register your phone number on the FTC’s Do Not Call registry (donotcall.gov). This could lower the amount of spam and robocalls you receive.

For peace of mind, consider signing up for identity theft protection.

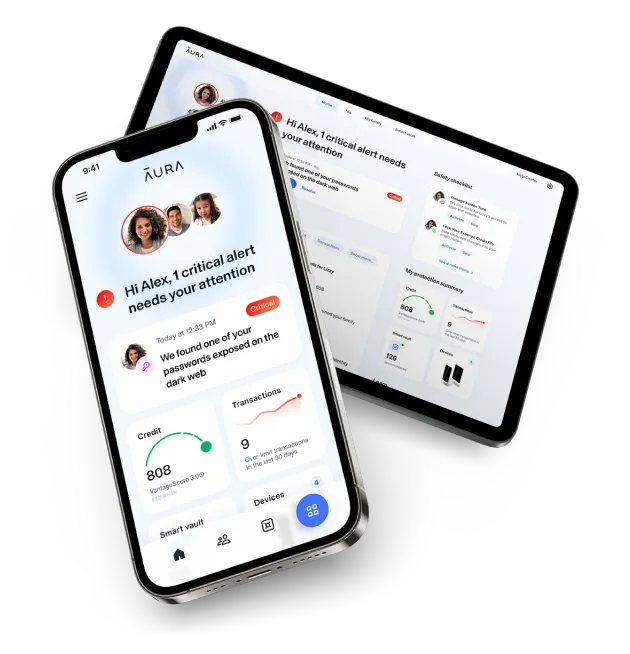

Even the best efforts get thwarted sometimes. Aura’s comprehensive plan extends beyond identity theft protection and provides overall fraud prevention, digital security, and financial and credit monitoring.

Plus, if the worst should happen, every adult member on an Aura plan is covered for up to $1,000,000 in insurance for eligible losses due to identity theft.

Shut down scammers and secure your finances. Try Aura free for 14 days →

Editorial note: Our articles provide educational information for you to increase awareness about digital safety. Aura’s services may not provide the exact features we write about, nor may cover or protect against every type of crime, fraud, or threat discussed in our articles. Please review our Terms during enrollment or setup for more information. Remember that no one can prevent all identity theft or cybercrime.

.png)