Allstate Identity Protection Review: What It Is and How It Protects You

Allstate began as a Sears-based car insurance provider in 1931. Nearly 100 years later, the company has branched into categories ranging from home and life insurance to identity and device protection.

As of 2022, the company claims to provide identity protection to more than five million Americans through Allstate Identity Protection (formerly known as InfoArmor) [*]. Depending on your plan, Allstate Identity Protection includes features such as:

- Allstate Digital Footprint®. Allstate helps you track your online activity, including your online accounts and browsing and shopping history. This feature warns you of exposed information and data breaches, unauthorized accounts, and misuses of your data.

- Credit monitoring. Allstate provides one-bureau credit monitoring through TransUnion (or three-bureau credit monitoring on its most expensive Blue plan), credit file inquiry alerts, and credit freeze assistance.

- Identity monitoring. Allstate monitors your personal information online and on the Dark Web — alerting you of leaks and other risks.

- Lost wallet assistance with “emergency cash.” If you lose your wallet, Allstate helps you cancel your cards and IDs and get replacements. If you have a Premier plan, you may get up to $500 in emergency cash.

- 24/7 fraud support. Allstate offers round-the-clock scam support. You'll also get free resources, tips, and tools from the Help Center, the Elder Fraud Center, and the Unemployment Fraud Center.

- Privacy management. Allstate helps you opt out of junk mail and scam calls. Blue plan members also get access to robocall and ad blocking.

- Insurance coverage for eligible identity theft expenses. Allstate offers up to $2 million to cover your out-of-pocket expenses if you become the victim of identity theft.

- Stolen funds reimbursement. If someone steals from your bank account, Allstate can reimburse you a maximum of $50,000 to $1 million, depending on your plan.

Allstate Identity Protection offers tiered plans with varying levels of protection and price points: Essentials, Premier, and Blue.

While the Premier plan offers ID theft and fraud protection, many of the most important features only come with the Blue plan, including cybersecurity protection, three-bureau credit monitoring, and parental controls.

Every tier offers individual and family options — for you and 10 family members — and comes with a 30-day trial. You'll get a discount if you pay annually; but Allstate’s prices will increase after year one.

The following breakdown highlights Allstate’s plans and pricing as of January 2025.

Essentials

$9.99/month (individual)

$18.99/month (family)

Includes identity monitoring, financial fraud protection, and one-bureau monitoring with TransUnion.

Essentials also includes up to $50,000 in stolen funds reimbursement and up to $1 million in identity theft expense reimbursement.

Premier

$17.99/month (individual)

$34.99/month (family)

Includes all Essentials features, plus financial account transaction monitoring, social media monitoring, and stolen tax refund advances.

Premier plans also offer up to $500 in stolen wallet emergency cash and up to $500,000 in stolen funds reimbursement.

Blue

$19/month (individual)

$36/month (family)

Includes all Premier features, plus family digital safety tools, a cybersecurity toolkit, and robocall and ad blockers.

Blue plans also offer a TransUnion credit lock and three-bureau credit monitoring, along with up to $1 million in stolen funds reimbursement and up to $1 million in stolen 401(k) funds reimbursement. Family plan includes up to $2 million in identity theft expense coverage.

🥇

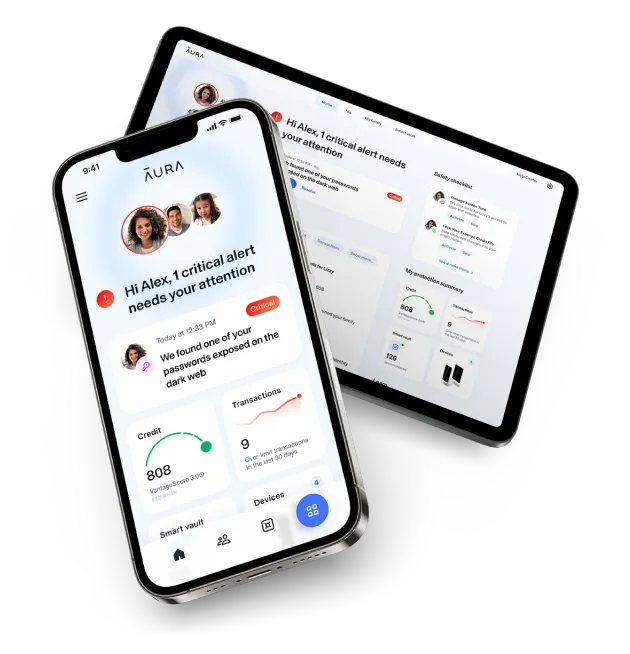

Identity theft protection doesn’t have to be complicated (or costly!) Aura’s all-in-one intelligent safety app provides stronger protection, faster alerts, and better value than Allstate. Try Aura

free for 14 days and see why it’s been rated #1 by

Forbes, Money.com, and more.

Who Can Benefit The Most From Using Allstate Identity Protection?

Like other providers, such as LifeLock, Allstate's identity theft protection services offer multiple pricing tiers. Consumers may opt for a plan without features like three-bureau credit monitoring or malware protection, possibly overlooking the added benefits these services provide.

However, there are a few specific scenarios in which you could be a good fit for Allstate’s identity theft protection, including:

- Large families looking for coverage. Allstate’s family plans cover up to 11 people on a single plan. This may include you, your partner, and dependent family members residing with you or financially supported by you. Caution: All authorized family members can view alerts, reports, and credit scores in your account.

- You’re willing to pay extra for three-bureau credit monitoring. Only the most expensive Allstate plan monitors your file with the three major credit bureaus — Equifax, Experian, and TransUnion.

- You have a budget for digital safety tools. If you want cybersecurity tools — including a virtual private network (VPN), password manager, and antivirus protection — you’ll need to pay for Allstate’s most expensive Blue plan. This plan also includes website blocking, screen-time management, and content monitoring tools.

The bottom line: Allstate makes strong claims about identity theft, hacking, and fraud protection. However, you should know the limitations before signing up. Next, we’ll dig into Allstate’s main features, how they protect you, and where (if at all) they fall short.

Allstate Identity Protection Features and Pros & Cons

According to Allstate, Identity Protection saved members more than $5 million in 2022 [*]. But what kind of protection does the service really offer?

Here’s a breakdown of the main pros and cons of using Allstate Identity Protection:

Affordable (but limited) starter plan.

Three-bureau credit monitoring and cybersecurity tools are only available on the most expensive Blue plan.

30-day free trial included on all accounts.

More expensive than most other identity theft protection providers.

Family plans cover up to 11 people, including you, your spouse, and any dependent children or family members.

All family members can access your dashboard and view alerts, credit scores, and updates.

Up to $2 million in identity theft insurance and stolen funds reimbursement.

Not an all-in-one app. Additional features require signing up for multiple services and apps.

Now, let’s delve deeper into the main features of Allstate Identity Protection and see what kind of value they bring.

The leading identity theft protection services track your personal information and alert you of any leaks or misuse. They look for your name, phone number, and Social Security Number (SSN), online and on the Dark Web, pointing out any suspicious or criminal activity.

How Allstate Identity Protection monitors your identity:

- Allstate Digital Footprint®. Allstate tracks the online accounts and websites that store your personal information, and warns you of data breaches or privacy issues.

- Dark Web monitoring. Allstate employees and bots scan multiple known sites on the Dark Web for your personal information, login credentials, and account numbers.

- Social media monitoring. Allstate scans your social media accounts and alerts you to account takeover red flags or inappropriate comments that could jeopardize your reputation.

Is Allstate's identity monitoring worth it? Allstate's “Digital Footprint” app tracks online accounts but not public and court records — meaning it won't know if a criminal uses your identity to commit a crime or buy a home. On Trustpilot, customers have reported problems with receiving and checking alerts — only finding out about data breaches and identity theft from other services [*].

Credit and financial monitoring

Credit monitoring services keep a close eye on your credit file and notify you of any changes. If someone inquires about new credit in your name or opens a new credit card, you'll receive an alert. Financial monitoring looks at unauthorized non-credit based transactions, such as savings accounts, student loans, and 401(k)s.

How Allstate Identity Protection monitors your credit and finances:

- Credit monitoring. Allstate only monitors your credit file with one bureau (TransUnion) on all but the top plan. With Allstate's Blue plan, you get three-bureau monitoring, credit score tracking and alerts, plus assistance with credit freezes.

- Financial monitoring. Allstate also lets you add savings and retirement accounts for monitoring (Blue plan only). You can set a transaction threshold that will trigger an alert when exceeded.

Is Allstate's credit monitoring worth it? Every American is entitled to free credit reports throughout the year from AnnualCreditReport.com, so credit monitoring must be reliable and fast to be worthwhile as a paid service. Yet, Allstate's alerts can come several weeks after an event, which might leave you open to fraud [*].

Identity theft insurance and support

Identity theft insurance covers the out-of-pocket expenses that result from identity theft. Stolen identities take time to recover and lead to lost wages — as well as legal fees and identification replacement costs.

What type of insurance Allstate Identity Protection provides:

- $1 million expense reimbursement. On all individual plans, Allstate offers up to $1 million per 12-month period to reimburse the expenses resulting from fraud, theft, forgery, embezzlement, or data breaches.

- Stolen funds and emergency cash. On the Premier and Blue plans, Allstate awards up to $1 million to reimburse stolen funds and up to $500 in emergency cash.

Is Allstate's identity theft insurance worth it? Allstate backs its top-paying customers with a quality identity theft insurance package; but members on the lowest membership tier only have access to $50,000 in stolen funds reimbursements and no emergency cash.

Device and data security

Modern cybersecurity packages provide comprehensive protection for your devices, privacy, and personal data. To keep hackers and scammers at bay, you need complete coverage that includes antivirus software, VPN, password manager, and a privacy assistant.

How Allstate Identity Protection secures your device and data:

- Antivirus software. Using a separate app from Bitdefender, Allstate protects its top-tier customers with malware detection and removal, network threat prevention, and system vulnerability assessments.

- Privacy tools. Allstate Identity Protection includes a VPN and a password manager, plus anti-spam filters, anti-tracker extensions, and webcam and microphone protection.

Is Allstate's device and data security worth it? Allstate provides somewhat effective device and data protection, but underwhelms in privacy services. You can receive help opting out of junk mail, but you won't get help removing your name from data broker lists [*].

Family protection

The best cybersecurity packages address the problem of child identity theft with ID and credit monitoring for kids. They also offer powerful parental controls that protect the young people in your household from the dangers of the internet.

How Allstate Identity Protection protects your family:

- Parental controls. Allstate's parental controls are powered by another third-party service (Bark) and include web-filtering technology, anti-phishing protection, and screen-time management tools.

- Location tracker. Allstate tracks your children's devices, letting you know where they are and requesting check-ins.

- Child identity theft monitoring. Allstate monitors the information and devices for up to 10 members of your family.

Is Allstate's device and data security worth it? Allstate Identity Protection has quality family controls, but some customers feel it falls short when it comes to monitoring your children's credit [*]. While family plans provide additional coverage, the prices are nearly double the cost of individual plans.

Identity restoration and customer support

After you detect fraud and identity theft, you need to restore your name and accounts. Thankfully, many identity theft protection services support and guide you through the stressful remediation process.

How Allstate Identity Protection restores your identity:

- Content Hub and Help Center. Customers can educate themselves with the resources and FAQs available on Allstate's Content Hub.

- 24/7 remediation support. Allstate's in-house support team is available 24/7 to walk you through the fraud remediation process. The company boasts a 98% satisfaction score from customers.

Is Allstate's device and data security worth it? Despite the advertised satisfaction scores, Allstate customers reported poor communication, long wait times, and inadequate support to the Better Business Bureau [*].

What Are the Downsides of Using Allstate Identity Protection?

Allstate claims that users are in "good hands," but its identity protection plans have some notable drawbacks that might make you think twice about signing up.

Take a look at the following downsides before you choose Allstate Identity Protection:

- Expensive compared to other (more comprehensive) options. You can get basic individual identity monitoring for $9.99 from Allstate, but the more comprehensive options — comparable to modern services like Aura — cost upwards of $19/month.

- Plan prices increase by more than 50% after your first year. Blue plans cost $190 for the first year and $280 for every year after that — an increase of more than 50%.

- Customers have trouble contacting support representatives. Allstate offers 24/7 customer support via phone. However, the lack of an email or live chat function may lead to significant wait times.

- Apps may have functionality issues. Allstate's mobile apps have negative reviews citing functionality challenges, including long load times, regular error messages, and login problems. You may also need separate apps for certain features.

- Limited credit monitoring on all but the most expensive plans. Two of Allstate's three plans only offer one-bureau credit monitoring. With the Essentials plan, you receive no credit reports and no transaction monitoring.

- Digital security on only one plan. Only Allstate's Blue plan offers cybersecurity and digital protection, including phishing protection, location tracking, and online family safety tools.

Why You Should Consider Aura as an Allstate Alternative

Allstate has been around for nearly a century, but that doesn't mean it's the best option for you. In fact, you'll find many alternatives that provide similar (or better) protection with even fewer drawbacks.

For example, despite being one of the newest options available, Aura has already won numerous accolades and been rated #1 by Money.com, TechRadar, and USNews.com for its modern take on identity protection.

Here’s a comparison between Allstate and Aura:

Starts at $9.99/month for the basic personal plan.

Three-bureau credit monitoring is offered only on the most expensive plan.

Three-bureau credit monitoring and financial transaction alerts are standard on all plans.

Basic digital security tools and spam call protection are provided on separate apps with the top plan.

Comprehensive digital security for 10 of your devices — plus antivirus, VPN, Safe Browsing tools, spam call protection, and more.

30-day free trial with the ability to cancel at any time.

Here’s why you should choose Aura over Allstate:

- Faster fraud alerts. Aura alerts you to credit and identity fraud or suspicious activity faster than Allstate Identity Protection. According to a 2022 mystery shopper survey, Aura’s credit fraud alerts were up to 250x faster than those of competitors3.

- Robust online security. Aura emphasizes online security with Safe Browsing tools, antivirus protection, and a VPN on every plan — not just the top tier.

- Better support that's there when you need it. Aura has a team of U.S.-based White Glove Fraud Resolution Specialists available 24/7 by phone. You can also reach them by email or live chat throughout the week.

- More comprehensive family protection and coverage. Aura's family protection plans cover multiple households to support any vulnerable family members. Every adult member on an Aura plan also receives up to $1 million in identity theft insurance (up to $5 million total for families) — covering lost wages, childcare costs, travel expenses, and more.

- Better value for more features. Aura offers simple pricing tiers for individuals, couples, and families. Every plan comes with digital security and three-bureau credit monitoring. Best of all, prices don't increase after year one.

💪

Ready to try Aura for yourself? Get Aura’s 360° protection against identity theft, fraud, and hacking

for just $9.99/month.

The Bottom Line: Allstate Isn’t Your Only Option

Allstate has a familiar name and offers a decent Identity Protection service, but its features don't suit everyone. With no financial monitoring, cybersecurity, or parental controls on the basic plans, only Allstate’s highest-paying members get complete protection. Even then, Allstate's coverage falls short when compared to some of its competitors.

For the most comprehensive protection and support, consider signing up for Aura and get more value for your money.

Aura offers one of the best identity theft protection services on the market, with award-winning identity and credit monitoring, real-time alerts, AI-powered digital security, and 24/7 Dark Web monitoring. Aura also has a dedicated team of Fraud Resolution Specialists waiting for your call, and provides a $1 million identity theft insurance policy for every adult on your plan.