In this article:

Identity Fraud vs. Identity Theft: What You Need To Know

While identity theft and identity fraud are similar, there are nuances between the two crimes that you should know about in order to stay safe.

While identity theft and identity fraud are similar, there are nuances between the two crimes that you should know about in order to stay safe.

Is Your Identity at Risk?

Technically, identity theft refers to the stealing of your personally identifiable information (PII), while identity fraud refers to the usage of your stolen information. The difference may seem small, but both are dangerous crimes that lead to serious consequences for victims.

According to the Federal Trade Commission (FTC) [*]:

Nearly 5.4 million Americans reported identity theft or fraud-related incidents in 2023 alone — with losses of $10 billion.

In this guide, we'll explore how identity theft and identity fraud happen, the risks you could face, and what to do if you think your identity is at risk or has been stolen.

{{show-toc}}

What Is Identity Theft? How Does It Happen?

Identity theft is the act of someone stealing any of your personal data — including your name, address, driver's license, Social Security number (SSN), or credit card information. It can happen quickly and without warning.

For example, one Houston woman had her identity stolen while applying for a job. After she filled out a W-4 form and supplied her SSN and a copy of her driver’s license, the “hiring manager” disappeared [*].

In Fairfield, Texas, a group of residents had their identities stolen when an identity thief broke into their neighborhood mailbox and stole tax return information among other pieces of personal data [*].

Here are the most common ways that identity thieves can get your information:

- Data breaches. Hackers steal and sell the personal information stored by third parties, such as apps, websites, and even government agencies. Last year, over 350 million people had their personal information leaked in data breaches [*].

- Phishing emails and other attacks. Using fake personas or social engineering, scammers convince unsuspecting people to share their personal and financial information. Imposter scams accounted for more than 850,000 of the reports fielded by the FTC in 2023 [*].

- Mail theft. In your mail, thieves can find account numbers and information from your debit card and credit card accounts, as well as SSNs and personal details sent from the Internal Revenue Service (IRS). Between 2018 and 2023, mail theft reports increased by more than 400% [*].

- Malware. By infecting your computer with malware and spyware, cybercriminals can watch over your online activity and extract your personal data. In 2023, the FTC received more than 60,000 reports of ID theft via malware and computer exploits [*].

What Is Identity Fraud? What Are the Risks?

Identity fraud occurs when fraudsters misuse your personally identifiable information (PII) for any reason. The consequences of identity fraud can include financial fraud, damage to your credit score, as well as legal and reputational repercussions that can span months or even decades.

In one case, a Los Angeles man spent two years behind bars after being arrested for crimes committed by an identity fraudster who had been using the victim’s SSN and personal information for nearly 40 years [*].

If criminals use your identity, they could potentially:

- Open new credit cards in your name. Fraudsters can use your identity and stolen bank details to open new credit cards and max them out. The FTC fielded more than 550,000 reports of identity theft and fraud that was related to credit cards and bank accounts in 2023 [*].

- Take over your accounts. Armed with your personal information and login credentials, identity thieves can break into your existing accounts, lock you out, and use them as their own. As of 2024, 29% of Americans have been victimized by an account takeover [*].

- Obtain loans and leave you on the hook for the payments. If a fraudster gets a loan in your name, you could be responsible for the payments and any repercussions for nonpayment. In 2023, nearly 150,000 fraudulent loans or leases were reported to the FTC [*].

- Use your name for tax fraud. Equipped with your identity, scammers can claim your tax credits — stealing your tax refunds and leaving you with possible legal ramifications. The FTC received over 60,000 reports of tax fraud in 2023 [*].

- Apply for government benefits in your name. Scammers can use your identity to steal your government benefits or apply for new ones, including Social Security, unemployment, and medical benefits. Between 2022 and 2023, government benefit fraud increased by 82%, the largest increase among all types of identity theft [*].

- Create fake IDs under your name. Armed with a fake ID, fraudsters can impersonate you and possibly commit crimes in your name. In 2023, the FTC took in over 20,000 reports of forged government documents [*].

The bottom line: A stolen identity can lead to criminals emptying your bank account, destroying your credit, or even committing crimes in your name. For protection and peace of mind, consider an identity theft protection provider.

Identity Theft vs. Identity Fraud vs. Synthetic Identity Fraud

Identity theft isn’t a single crime. Once you become a victim of identity theft, scammers can use your identity for numerous types of identity theft and criminal activity.

The table below explains some of the most common ways that your stolen identity can be used and the risks involved, along with examples so that you will know what to look out for:

What To Do If You Think Your Identity Was Stolen

The warning signs of identity theft come in many forms, such as suspicious activity on your credit report, unauthorized withdrawals from your bank account, or strange phone calls or mail referring to unfamiliar accounts or debts.

If you see any red flags, act quickly so that you will have the best chance to stop fraudsters before they can do significant damage to your finances, credit, and reputation.

Here are a few steps you can take right away:

- Freeze your credit. When in doubt, freeze your credit with all three major credit bureaus — Equifax, TransUnion, and Experian. This will prevent fraudsters from accessing your credit file while you investigate further.

- Secure your accounts. Change the passwords on your online accounts — including your bank, email, and e-commerce accounts. Create unique and complex passwords for each account, and enable two-factor authentication (2FA) whenever possible.

- Review your credit report. Order a free credit report from AnnualCreditReport.com and carefully go through it, noting any incorrect information or unauthorized activity. You can then dispute any errors and fraudulent activity directly with each credit bureau.

- Report the theft and/or fraud to the FTC. File a report with the FTC at identitytheft.gov to receive an official Identity Theft Affidavit, which you can provide to your bank and other affected organizations. You can also report fraud and scams at reportfraud.ftc.gov.

- File a police report. Visit or call your local law enforcement office to file an official police report. You may also need a copy of this report to give to your bank to dispute fraudulent transactions or close down accounts.

- Contact your financial institutions. Reach out to your bank and credit card companies and report the identity theft to their fraud departments. They may flag your accounts and watch them closely or advise you to cancel your cards and open new accounts.

- Contact affected organizations. Call and inform any organizations that have been impacted by the identity theft. They can then open internal investigations or even possibly reverse the fraud while you have them on the phone.

- Run antivirus software. Scan your devices to see if scammers have infected them with malware. Antivirus software will identify, quarantine, and remove any malicious files or programs, as well as prevent future attacks.

- Practice good cyber hygiene. Take essential cybersecurity measures, such as making sure to stay on top of all device and system upgrades, avoid clicking on links, and don’t share your personal information online.

- Take advantage of support for victims of identity theft. There are government agencies and dedicated companies available to help you navigate your recovery from identity theft. Here’s a comprehensive list of where you can find identity theft victim assistance.

Is Identity Theft Protection Worth It?

Identity theft can have devastating and lasting effects on victims. In 2023 alone, victims lost $10 billion and spent countless hours dealing with the consequences of identity fraud [*]. The IRS, for example, takes an average of 650 days to resolve identity theft cases [*].

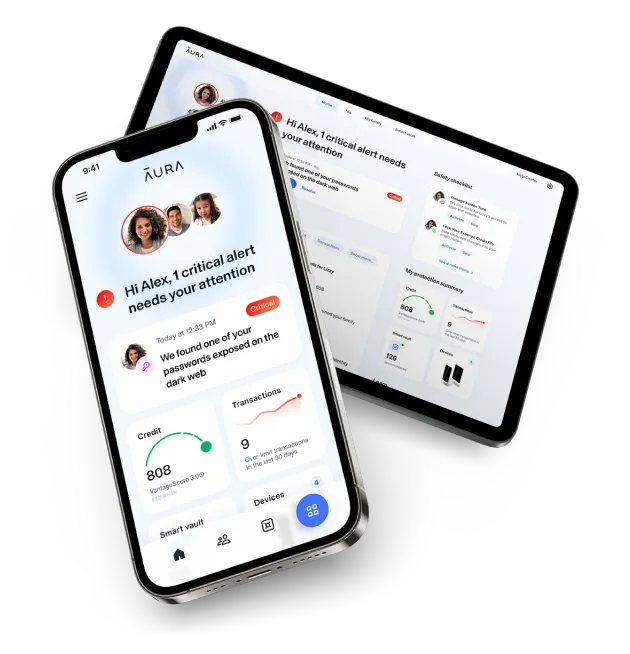

That's one of the reasons why so many consumers have turned to identity theft protection providers like Aura. Identity theft protection safeguards your information and accounts against scammers and hackers and alerts you to the slightest hint of fraud.

With Aura, you get:

- Identity monitoring and alerts. Aura monitors over 100 pieces of sensitive personal information — including contact details, passwords, credit card numbers, and more — across the internet, Dark Web, and public records.

- Credit monitoring and fraud protection. Aura’s ID theft protection extends to your credit file and financial accounts with three-bureau credit monitoring, suspicious activity and transaction alerts, and the industry’s fastest fraud alerts3.

- Digital security tools. Aura proactively protects you and your whole family against hackers and data breaches with advanced security tools. Every Aura plan includes antivirus protection, a military-grade virtual private network (VPN), secure password manager, Safe Browsing and phishing protection tools, and more.

- 24/7 assistance from trained identity restoration specialists. Whether you have questions or think you’ve been targeted by scammers, Aura’s dedicated team of White Glove Fraud Resolution experts is available 24/7/365 to help you recover accounts, dispute fraudulent accounts, and secure your identity.

- $1,000,000+ insurance to cover eligible losses and expenses. If the worst should happen, Aura includes a $1 million insurance policy per every adult member on your plan — covering eligible losses resulting from identity theft, including legal fees, lost wages, and stolen funds.

While identity theft protection can help shield you and your family from the worst impacts of identity fraud, no plan or provider can promise complete identity theft prevention. However, the benefits of Aura’s award-winning safety solution go well beyond just warning you about potential fraud by providing comprehensive security features and round-the-clock support.

Stay safe with proactive protection against identity theft. Try Aura free for 14 days.

Editorial note: Our articles provide educational information for you to increase awareness about digital safety. Aura’s services may not provide the exact features we write about, nor may cover or protect against every type of crime, fraud, or threat discussed in our articles. Please review our Terms during enrollment or setup for more information. Remember that no one can prevent all identity theft or cybercrime.