In this article:

How to Avoid The Latest Charity Scams (2023)

The last thing you want when donating money is to send it to a scam charity. Learn how to sport charity fraud and avoid charity scams.

Are You Dealing With a Fake Charity?

Scammers know that one of the easiest ways to trick victims into giving up money is by tugging on their heartstring — and nowhere is that more true than with charity scams.

Fake charities, fundraisers, and nonprofit groups claim to help meaningful causes, but do little real work, misappropriate funds, or even siphon charitable contributions into their own pockets.

According to the latest data from the FBI [*]:

Americans lost $4.4 million to charity fraud — not including money lost to fake online fundraisers.

Before you donate, you want to make sure that your money is going to the right cause — not a scammer’s pocket.

In this guide, we’ll explain how charity scams work, the warning signs to look out for, and how to ensure your money is going to the right place when you donate.

{{show-toc}}

What Are Charity Scams? How Do They Work?

Charity scams occur when fraudsters and scam artists create fake or misleading charitable organizations to trick you into giving up money or providing personal information that can be used for identity theft.

These scams can be run by scammers taking advantage of natural disasters and social issues or even

Here’s how a typical charity scam works:

- Fraudsters create a fake charity and pretend to support a cause you care about. Scammers often latch on to events in the news — such as natural disasters or political issues — to try and solicit donations. They’ll often use legitimate-sounding names to try and trick you into trusting them, such as Direct Relief International [*].

- Next, they reach out to solicit donations. Charity scammers will reach out via email or text messages, create fake social media pages and GoFundMe campaigns, or even employ telemarketing companies to solicit donations.

- During the donation process, you’ll be asked to provide personal information. If you engage and want to donate, you’ll be asked to supply personal information, such as your name, home address, phone number, email, and even more sensitive information including your Social Security number (SSN). If you push back, the scammers will claim they need the information for tax credits or other reasons.

- After you donate, you’ll continue to be harassed by other “opportunities.” Scammers want to squeeze victims for as much as they can. If you donate to one fake charity, expect to be contacted by more in the future.

The Most Common Types of Charity Scams

- Fake charities impersonating well-known charitable organizations. Criminals set up a copy of a well-known or popular charitable organization to siphon away donations from the real charity. In one example, a man in New York set up 76 fake charities using names that were similar to well-known charities such as the American Cancer Society. The kicker? All of his fraudulent charities were approved by the Internal Revenue Service (IRS) [*].

- Fraudulent disaster relief charities. When widespread natural disasters, wars, or humanitarian issues strike, numerous charities emerge to start raising funds. Scammers set up fake nonprofits to take advantage of compassionate people who want to do their part in a time of crisis.

- Scammy GoFundMe accounts and social media fundraisers. Fraudsters post stories and photos on social media and crowdfunding platforms to garner pity and raise money. They may even steal someone else’s photos and true stories and use them for their fake posts.

- Holiday-themed charity scams. Many fake charities pop up during the holidays when average people are more likely to donate. Holiday charity scams are especially prevalent on social media.

- Veteran, police, and firefighter charity scams. Some scammers say they’re collecting donations to help local public servants or even military veterans.

- Dishonest charities that misuse funds. Many charities might be technically legitimate, but purposefully misuse the funds they receive. In other words, a disproportionate amount of contributions go towards inflated expenses and salaries, rather than the charity’s intended recipients.

How To Identify Charity Scams (and Stay Safe)

- Check the charity’s credentials on charity watchdog sites

- Conduct your own online search about the charity

- Scrutinize the charity’s name

- Ask about and verify their nonprofit status

- Avoid nontraditional payment methods

- Research the charity’s mission statement and track record

- Beware of links on social media or in unsolicited emails

- Look out for high-pressure sales tactics

- Don’t give away personal information

- Keep records of your donations

When you want to help, do everything you can to ensure that your charitable donation doesn’t fall into the wrong hands.

Here are the most important things to look out for when you research where to donate:

1. Check the charity’s credentials on charity watchdog sites

If you spot an organization that you’d like to support, you can use these websites and resources to check whether or not they are a legitimate charity:

- CharityNavigator.org is a great resource for people who are looking for reputable giving organizations. The website contains a rating system for each charity, which allows you to make a more informed decision about where your money is going.

- The Better Business Bureau’s Wise Giving Alliance features accredited charities and a searchable database in case you need to verify a charity’s website that you find independently.

- CharityWatch.org places special emphasis on financial transparency and unbiased reporting. Search results include a detailed rating system, and provide insight into how specific charities distribute their cash flow.

- Guidestar.org is another searchable charity watchdog website that aims to help individuals make informed donation decisions. This online resource emphasizes its efforts to provide the most up-to-date information possible about each nonprofit that they analyze.

🎯 Related: How To Tell If Someone Is Scamming You Online →

2. Conduct your own online search about the charity

Some smaller or new charities won’t appear on larger watchdog sites. If you still want to donate, do your own research by searching the charity’s name, along with the words “complaints,” “reviews,” “ratings,” and “scam.”

Conduct these searches individually for more targeted results — for example, “[charity name] + scam.”

3. Scrutinize the charity’s name

Scammers often create a dummy organization with a name that is practically indistinguishable from an accredited or well-known charity. For example, a fake charity might call themselves “U.S. Red Cross” hoping they’ll be mistaken for the American Red Cross.

Here’s what you can do to make sure you’re not donating to a lookalike charity:

- After looking up the charity on a watchdog website, revisit the charity’s website and make sure the web address is exactly the same and isn’t misspelled.

- Cross-reference the charity’s contact information from the watchdog website to the website you found. Are the customer service phone number and email address the same?

🎯 Related: How To Quickly Identify a Fake Website →

4. Ask about and verify their nonprofit status

Charitable organizations must maintain a nonprofit status to be accredited. Verifying a charity organization’s nonprofit status is an important part of your research because tax-deductible donations are a defining characteristic of charities in general.

Contact the organization personally and request proof of their nonprofit status — but don’t immediately trust their response before doing more digging.

Since charities are tax-exempt, they must report their earnings with the IRS by filing a 990. You can use the IRS’ Tax Exempt Organization Search Tool to learn more about an organization’s history and current status.

Be careful: A nonprofit status doesn’t guarantee that a charity is legitimate. In many cases, scammers are able to apply for and be granted tax-exempt status. Make sure to look for other signs that you’re dealing with an online scammer.

5. Avoid nontraditional payment methods

One major red flag of a charity scam is if they only accept donations via non-traditional payment methods. This includes cryptocurrency, gift cards, wire transfers, payment apps like Cash App, Venmo, and Zelle, and cash, as these are either untraceable or very difficult (if not impossible) to dispute and refund.

In certain fundraising situations, especially in-person events, cash payments might seem natural or reasonable. However, cash donations are not recommended unless you know and trust the charity.

6. Research the charity’s mission statement and track record

Any legitimate charity should have a detailed mission statement and be able to describe their giving strategy, history, and current work in detail. Here are a few ways to check a charity’s validity:

- Check their website: Visit the charity’s official website and pay special attention to the “about us” and “mission statement” information.

- Ask for their methods and results: Ask how much of your donation goes towards the cause. Look for figures that demonstrate the success of their work and the impact it has made.

- Get on the phone: If you notice any vagueness or hesitation while answering your questions, consider taking your donation elsewhere.

7. Beware of links on social media or in unsolicited emails

Social media can be a great place to spread awareness about causes — but it can also allow scammers to target unsuspecting victims with sham charities. When considering a charity on social media, make sure to follow these precautions:

- Don’t donate directly from information found on a social media account. It’s easy for a scammer to spoof a charity’s official page and collect some of their traffic.

- Don’t act on unexpected solicitations that claim to be from charitable organizations. Unsolicited emails and texts about fundraising veer too far into scam territory, where you risk sending money to an unintended recipient.

- Learn more about phishing emails and text message scams so that you can recognize a suspicious message as soon as you receive it.

🎯 Related: The 11 Latest Facebook Scams You Didn’t Know About →

8. Look out for high-pressure sales tactics

Most charitable causes have passionate leaders behind them — but any behaviors beyond encouragement and information should be regarded as a red flag. If someone is putting undue pressure on you to donate, take a step back and consider other options.

9. Don’t give away personal information

Legitimate charities will ask for your contact details — but scammers take this a step further and request sensitive details that can be used to steal your identity. Don’t give out your bank account number, date of birth, SSN, or other sensitive data to strangers — even if they appear to be working for a good cause.

🎯 Related: What Can Someone Do With Your SSN? →

10. Keep records of your donations

Keeping track of all the charitable donations that you make is an important part of financial health. Record-keeping also helps you verify that all of your financial transactions are legitimate.

When you donate, ask for a receipt and ensure the amount charged to your bank account matches what you wanted to donate. If you see an additional charge for a contribution that was not meant to be recurrent, contact your financial institution right away. You could be dealing with charity fraud.

Did You Give Money to a Fake Charity? Do This!

If you discover that your donation went to a scammer instead of an important cause or a community in need, don’t let the crime go unreported. Protect your finances and sensitive data, and help bring justice to the con artists behind fake charities.

Here’s what you can do:

- Create a detailed report of the scam, including documentation of your donation, the name of the fake charity, and any other aspects of the scam that you recall.

- Report the fraud to the Federal Trade Commission (FTC) online at ReportFraud.ftc.gov. If you gave the scam charity your personal information, you should also file an official identity theft report at IdentityTheft.gov.

- Report the charity to the IRS and your state’s attorney general. Fill out IRS Form 13909 to lodge a formal complaint about a supposedly tax-exempt organization. You can also file a complaint with your state’s charity regulator.

- If the fraud took place on a social media platform or a fundraising website, report the fraud to them as well.

- Regularly monitor your accounts for signs of fraud or suspicious activity. You may also want to consider signing up for a credit monitoring service.

- Secure your devices and online accounts by changing your passwords and enabling two-factor authentication (2FA) wherever possible.

- Place a freeze on your credit reports with each of the three bureaus — Experian, Equifax, and TransUnion — so that no new accounts can be opened in your name.

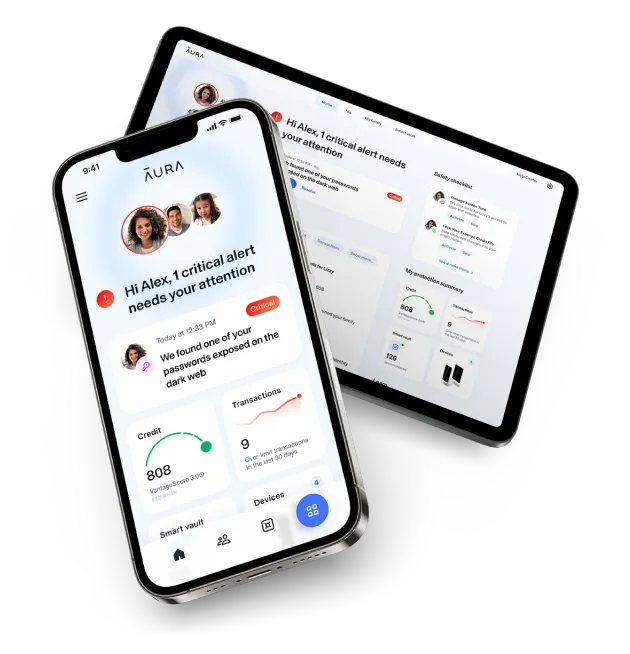

- Consider signing up for Aura’s identity theft protection services for continual monitoring and protection of your sensitive information.

The Bottom Line: Don’t Accidentally Donate to Scammers

Charitable giving shouldn’t be a risky business. You can reduce the risk of following a few simple steps before you donate:

- Verify the charity on a trusted watchdog site, such as the BBB Wise Giving Alliance (and similar)

- Conduct your own research online to ensure that the charity is legitimate and that you agree with its mission

- Choose a secure payment method, like a credit card or check

- Avoid charities with high-pressure sales tactics

- Don’t provide detailed personal information when you donate

- Keep records of your donations and monitor your bank and credit statements for signs of fraud

- When in doubt, look elsewhere

If an organization you chose to support isn’t what you thought it would be, an online protection provider like Aura can notify you immediately if your financial information is compromised or if you’re at risk for identity theft.

Plus, every member of an Aura plan gets 24/7 access to White Glove Fraud Resolution specialists and up to $1 million insurance coverage for eligible losses due to identity theft.

Don’t leave your personal security up to chance. Try Aura free for 14 days →

Editorial note: Our articles provide educational information for you to increase awareness about digital safety. Aura’s services may not provide the exact features we write about, nor may cover or protect against every type of crime, fraud, or threat discussed in our articles. Please review our Terms during enrollment or setup for more information. Remember that no one can prevent all identity theft or cybercrime.