In this article:

How To Choose the Best Home Title Protection Service

Home title protection services claim to warn you when scammers try to “steal” your deed — but only a few services are really worth your money.

Home title protection services claim to warn you when scammers try to “steal” your deed — but only a few services are really worth your money.

Is Home Title Protection Really Necessary?

Home title protection services claim to monitor your home title and alert you if scammers are trying to use a forged deed to take out loans or lines of credit against your property, steal your home equity, or illegally rent or sell your home. But are these services really necessary?

Not according to Maryland Attorney General, Brian E. Frosh, who said:

“[Home title fraud] is very rare, and hardly ever successful. Monitoring your identity is the best way to stop fraud in its tracks.” [*]

The truth is that home title theft is identity theft. Fraudsters use your stolen information to impersonate you and attempt to transfer or fraudulently use your deed.

Services that only monitor public forums — and send you alerts about suspicious activity relating to your property — are a waste of money. This is particularly true if you live in states like Florida [*] and Georgia [*] that already offer free notification services for changes in property records.

Instead, you’re much better off signing up for an all-in-one identity theft protection provider that does much more than just monitor your home title.

Key takeaways

- The FBI received 9,521 complaints about real estate-related fraud in 2023, with victims losing more than $145 million — but there’s no data available on how many of these scams involved home title or deed theft [*].

- Home title protection services don’t stop identity thieves from exploiting you with other scams if they have your personally identifiable information (PII).

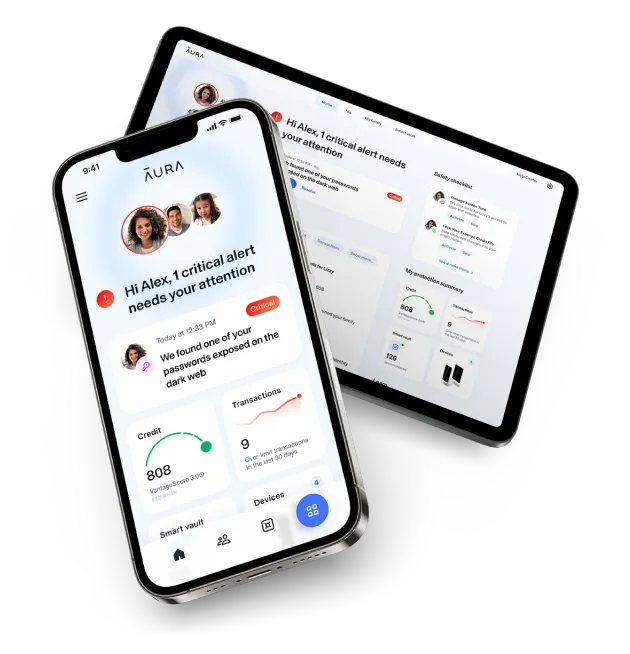

- Aura is a top pick for home title monitoring, providing an all-in-one identity theft protection solution for less money than most stand-alone home title monitoring services.

Is Home Title Lock Worth the Money?

In short, no. Many brands, especially Home Title Lock, exaggerate the threat of home title theft. Even the Federal Trade Commission (FTC) recently published a warning that Home Title Lock’s ads are “just a ploy to scare you” [*].

Home Title Lock — and other stand-alone home title protection services — charge a premium to monitor your home title for changes and send you fraud alerts. But this vastly oversimplifies what it would take for scammers to actually steal your home deed.

The home-buying process is complex, involving notaries, witnesses, and other due diligence paperwork that scammers would have to navigate in order to take advantage of your home title.

If scammers have enough information to steal your home title, it’s much easier for them to target your bank accounts or attempt different types of identity theft — from which Home Title Lock cannot protect you.

The title insurance policy you got when you bought your home isn’t going to help you, either. These insurance companies only protect against past lawsuits or liens against your property, not present-day fraud.

Identity theft protection providers, like Aura, include home title monitoring as part of a more robust identity monitoring system. Here’s how Aura and Home Title Lock compare:

The bottom line: Aura provides more extensive protection, 24/7 U.S.-based support, and a generous insurance policy for every adult on your plan. All of this comes at a fraction of the cost of services like Home Title Lock. Sign up for Aura today for as little as $9.99/month.

What To Look For in a Home Title Monitoring Service

- Extensive monitoring. Seek out services that send near real-time alerts about any unauthorized changes relating to your property address, deeds, loans, and legal materials. Make sure it covers every property that you own — not just one.

- Identity theft protection. Services with built-in identity monitoring alert you as soon as your SSN, online account credentials, or any other data has been compromised — helping to reduce the chances of full-blown identity theft.

- 24/7 support. When your deed or identity is stolen, the last thing you want is to be left on hold waiting for help. Seek out services with U.S.-based restoration specialists who can assist you right away, no matter when you call.

The 5 Best Home Title Protection Services Right Now

You can manually keep tabs on your home title and financial accounts by checking with the county recorder and reviewing your credit files. Americans can get free weekly credit reports from all three credit bureaus by visiting AnnualCreditReport.com.

But if you want a service that saves you time and worry, you should consider one of the best home title protection options. Here’s how they compare:

1. Aura

Why we picked it: Rather than only focus on your home title, Aura includes home title monitoring along with robust identity and credit monitoring, powerful digital security tools, and 24/7 U.S.-based support.

Aura is one of the top identity theft protection services — with multiple #1 reviews from publications including USNews.com, Forbes, TechRadar, Tom’s Guide, and more.

Some of Aura’s standout features include title monitoring for your home and auto titles, three-bureau credit monitoring with the industry’s fastest fraud alerts3, Dark Web and data breach alerts, antivirus software, a secure password manager, and a military-grade virtual private network (VPN) to protect your devices and data against cybercriminals.

Best plan & average cost: Aura Individual ($9.99/month) or Family ($24.99/month), using this special discount link. All annual plans include a 60-day money-back guarantee.

Note: Aura’s Family Plans also include child identity theft protection, parental controls, safe gaming, and up to $5 million in identity theft insurance coverage.

Our verdict: Aura is an affordable, fully integrated security solution that helps preserve your personal information, assets, and identity. Individuals and families can benefit from optimal home title protection — along with advanced digital security tools, Dark Web monitoring, 24/7 credit monitoring, and more.

2. Identity Guard

Why we picked it: Identity Guard is another all-in-one solution that combines home title monitoring with identity and credit fraud protection. Identity Guard is one of the most well-established brands in identity protection and has helped keep over 38 million people safe from fraud and scams.

Identity Guard prevents scammers from exploiting your home title by tracking the Dark Web and public records and alerting you to suspicious activity in near real-time. The app also makes it easy to keep track of your assets, constantly monitoring credit files and investment accounts, and providing updated risk management reports.

Best plan & average cost: Identity Guard Ultra ($17.99/month for individuals or $23.99/month for families).

The Ultra plan comes with three-bureau credit score monitoring, Experian CreditLock, and White Glove Fraud Resolution support. Identity Guard doesn’t offer a free trial but includes a 60-day money-back guarantee on all annual plans.

Our verdict: Identity Guard provides robust protection against identity theft and other forms of financial fraud, but you can’t get home title monitoring unless you buy one of its higher-tiered plans.

3. Home Title Lock

Why we picked it: This app has made a name for itself as one of the best home title protection services, thanks mainly to its signature TripleLock™ Title Protection.

On its website, Home Title Lock claims to be “the leader in home title fraud protection” and has an A+ rating with the Better Business Bureau (BBB) [*]. But its consumer reviews tell a different story. With a 3.2 rating on Trustpilot [*] and a 3.15 rating on the BBB [*], Home Title Lock has a reputation for hanging up on customers, exposing personal information, and generally being unresponsive.

It’s important to note that Home Title Lock only protects your home title — it won’t shield against identity theft, fraud, or hackers.

Best plan & average cost: Monthly one-property coverage at $19.95/month.

Our verdict: Behind the clever TripleLock™ Protection name is the same set of core features that most leading providers offer: always-on monitoring, urgent alerts, and title restoration services. You’re better off finding a provider that also helps protect you against other forms of identity fraud.

4. LifeLock Home Title Protect

Why we picked it: LifeLock Home Title Protect is Norton's dedicated service for protecting your home title from fraud. This service can monitor an unlimited number of properties that you own, including vacation homes and rentals.

LifeLock will alert you to changes made to your home title at the County Recorder’s Office. You’ll get notifications about items such as mortgage refinances, new properties under your name, and notices of default or foreclosure.

This service — which is different from LifeLock’s other plans that include identity and credit monitoring — only includes home title monitoring.

Best plan & average cost: LifeLock Home Title Protect is a stand-alone product priced at $9.99/month or $99.99/year.

Note: Lifelock’s Ultimate Plus Individual and Family plans also include home title protection, and start at $19.99/month and $32.99/month, respectively.

Our verdict: Dedicated identity restoration specialists and thorough real estate fraud monitoring make this software a solid line of defense. However, any recent activity on your property will not be available until the recorder’s office has processed it. By that point, you may already be the victim of identity theft or financial fraud. To catch these scams early, you have to add on other digital safety features at Norton’s steep prices.

5. Deed Shield

Why we picked it: While most home title protection services typically boast well-known brand names, Deed Shield is an under-the-radar tool that provides Florida homeowners with alerts and assistance if anything fraudulent happens to their property files.

Created by an attorney and title agent, Deed Shield constantly monitors key databases, including county public records and the websites of county property appraisers and tax collectors.

The company guarantees “no contracts, hidden fees, or surprises,” and maintains that it doesn’t do business with IT companies or agencies. But it doesn’t elaborate on its customer service availability or any other features built into the platform. And it doesn’t have any customer feedback on popular review sites like Trustpilot.

Best plan & average cost: There is one monthly plan: $9.99 per month per property.

Our verdict: Though Deed Shield protection is only available to Florida property owners, the company has become a popular choice because of the plethora of second homes in the area. Deed Shield is a good low-tech option and can help elderly homeowners protect against deed fraud and mortgage scams. But it’s still more expensive than other tools.

How To Protect Your Home From Deed Fraud

As Maryland Attorney General, Brian E. Frosh explains, identity monitoring is the best way to protect your home title and shield yourself from fraud.

Reviewing your property records and credit reports can help you detect fraud, too. But depending on when you check them, scammers may have already wreaked havoc on your home and your identity.

Along with signing up for an identity theft protection provider, you can use the following steps to help keep yourself and your home safe:

- Monitor your mail. Missing mail is a clear sign of identity theft (and potential home title fraud). Consider signing up for USPS Informed Delivery to preview your incoming mail via USPS’s mobile app.

- Safeguard your personal information. Scammers need your personal information to commit fraud. Limit what you share online and on social media, and look into Dark Web monitoring and data broker opt-out tools to reduce the amount of sensitive data available to scammers.

- Freeze your credit. Fraudsters may try to use your personal information to open new accounts or take out loans. A credit freeze prevents lenders from accessing your credit file, which should stop (or at least slow down) scammers trying to take advantage of your credit. To enact a freeze, contact each of the three bureaus individually: Experian, Equifax, and TransUnion.

- Lock down your online accounts. Reused or weak passwords can make it easier for hackers to gain access to your sensitive online accounts — especially after a data breach. Make sure you’re using strong and unique passwords for each account, as well as enabling two-factor authentication (2FA) whenever possible. A secure password manager makes it easier to create, store, and use stronger passwords, and can even warn you if your credentials have been compromised.

Editorial note: Our articles provide educational information for you to increase awareness about digital safety. Aura’s services may not provide the exact features we write about, nor may cover or protect against every type of crime, fraud, or threat discussed in our articles. Please review our Terms during enrollment or setup for more information. Remember that no one can prevent all identity theft or cybercrime.